However, a pour over will must be probated. If you fund the trust during your lifetime and later become incapacitated, the successor trustee will be able to manage the trust assets for your benefit. Walter has top-level experience from Rajah & Tann LLP (arbitration, commercial, civil, matrimonial, drafting contracts) and Lee & Lee (arbitration, commercial, civil, matrimonial, criminal). What components are needed to prove negligence? A paralegal is a person who has studied law and is aware about its provisions and requirements. You can use WillMaker & Trust to make a living trust online, or on your desktop. In some jurisdictions, a complete stranger may even be able to access it online. In case any property is mistakenly left out of the trust, the pour over will transfers those leftover assets to the trust. For help on choosing a good estate planning attorney, read How to Find an Excellent Lawyer. The cost to maintain documents over time through local attorneys is usually exorbitant as well. We really thought about doing Legal Zoom, but I wanted to do it RIGHT (in retrospect, I think Legal Zoom would have been fine, but we have an LLC that I wanted to make sure would be taken care of Id check out Legal Zooms current pricing you get access to a lawyer). ParaLegal Advice will help anyone, anywhere find the right Canadian Paralegal Services anywhere in Canada. It is certainly cheaper (but also be aware they charge extra for the house deed, etc). Ensure your familys privacy. Lawyers.com Chat Now Get a FREE case evaluation from a local lawyer The trust is signed by the grantor in front of a notary public. The probate process can be costly (depending on your state laws, it actually isnt too much in AZ) and can take a lot of time. If an attorney prepared this document for you I would recommend having an attorney update it for you. Common questions about our living trust package You show some evidence of your identity, and then the notary watches you sign the trust document and signs and dates it, too. Step 3 Complete a Massachusetts Firearm Bill of Sale. Read on to learn how living trusts help avoid probate, how to make a living trust, and whether you can make one yourself. Once the preparation of your documents is completed, you will be expected to figure out how to handle everything else. The executors of our trust (which is my son, followed by my mom and brother), How our trust income will be doled out to kids (we dont give them a lump sum they get a certain % as they age, beyond the money to raise them or to go to college), Every single bank account we own (including HSAs), Life Insurance (from both spouses) btw, if you dont have it check out, Our business (we are now listed as co-trustees of our trust on our LLC documentation), Our home (the living trust is listed on the deed to our home), Deciding who was going to be your childrens guardian (if applicable), Deciding how any assets (including digital assets) would be distributed (our kids get them slowly as they grow up, vs a lump sum), People he can speak to about healthcare decisions (for me, I will list some of the nurses I trust at work). You, as the grantor, transfer title of your assets into the trust. BUT, in looking at the pricing. LegalZoom provides access to independent attorneys and self-service tools. Most grantors name themselves as trustee so they can maintain complete control over the trust assets. Placing certain assets in a Revocable Living Trust can ensure that a trusted family member or friend, known as your successor trustee, can control the assets Can I use a Divorce Paralegal instead of an Attorney? Our products are covered by our No Hassle return policy. To set up a living trust, you must write a trust agreement and then properly fund the trust with assets. Trust types and codes. We are proud members of the California Legal Document Association, CALDA. WebArizona Statewide Paralegal offers assistance with estate planning legal documents, without the high price tag that comes with hiring an attorney. 1.

A living trust is a legal document that lets you determine who will take ownership of your assets following your death. Although I am pretty sure we couldve easily done the LLC portion ourselves for about half that cost, I was just ready to be done at that point. The living trust deals ONLY with assets and doesnt talk at all about what would happen to your children or any assets not specifically in the living trust. But only preparing a will is not sufficient because it addresses the issue of wealth division after the persons death. Hilary is a mom to 3, and a wife to 1. The trustee maintains a record of all trust property in a trust portfolio. In the first issue, authors Carolyn Reers and Mi-Hae Russo discuss the interconnectivity of living, working, and investing across borders and how it can lead to risks for trusts. Use of our products and services are governed by our Stocks and Bonds Held in Certificate Form. If you own a car or boat, you will need to have these assets retitled, as well. For example, you'll want to consult an attorney if: But even if you do go the lawyer route, it's worth doing a little research on your own; it's a lot more cost-efficient than paying a professional to educate you about the basics. Name and identify the trust. The statements and opinions are the expression of the author,

A living trust is a legal document that lets you determine who will take ownership of your assets following your death. Although I am pretty sure we couldve easily done the LLC portion ourselves for about half that cost, I was just ready to be done at that point. The living trust deals ONLY with assets and doesnt talk at all about what would happen to your children or any assets not specifically in the living trust. But only preparing a will is not sufficient because it addresses the issue of wealth division after the persons death. Hilary is a mom to 3, and a wife to 1. The trustee maintains a record of all trust property in a trust portfolio. In the first issue, authors Carolyn Reers and Mi-Hae Russo discuss the interconnectivity of living, working, and investing across borders and how it can lead to risks for trusts. Use of our products and services are governed by our Stocks and Bonds Held in Certificate Form. If you own a car or boat, you will need to have these assets retitled, as well. For example, you'll want to consult an attorney if: But even if you do go the lawyer route, it's worth doing a little research on your own; it's a lot more cost-efficient than paying a professional to educate you about the basics. Name and identify the trust. The statements and opinions are the expression of the author,  Legal Trusts are sometimes referred to as valid Trusts. WebParalegal Job Purpose: Responsible for supporting our estate planning and probate/trust administration practice areas. It is worth paying extra to have peace of mind that it is done correctly. It is a revocable document, i.e. I am sure moving the LLC was another $200 but I have no idea, because that just seemed liketoo much. When you use a trust, your assets are passed according to the instructions you include in the trust document. LegalZoom.com, Inc. All rights reserved. The name of the person who will manage the trust (the trustee ). This is where you may need to speak with an Arizona estate planning attorney to discuss the type of assets you have and whether a living trust is the best option for your estate planning needs. Aliving trust is a document that places your assets into a trust during your life and then distributes them to your beneficiaries after your death.

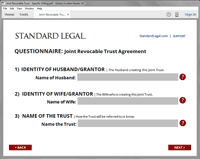

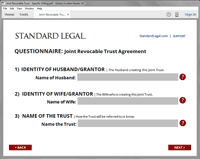

Legal Trusts are sometimes referred to as valid Trusts. WebParalegal Job Purpose: Responsible for supporting our estate planning and probate/trust administration practice areas. It is worth paying extra to have peace of mind that it is done correctly. It is a revocable document, i.e. I am sure moving the LLC was another $200 but I have no idea, because that just seemed liketoo much. When you use a trust, your assets are passed according to the instructions you include in the trust document. LegalZoom.com, Inc. All rights reserved. The name of the person who will manage the trust (the trustee ). This is where you may need to speak with an Arizona estate planning attorney to discuss the type of assets you have and whether a living trust is the best option for your estate planning needs. Aliving trust is a document that places your assets into a trust during your life and then distributes them to your beneficiaries after your death.  Avoid probate. Some of these are: Weve mentioned both a Pour Over will and a living will. The federal estate tax currently applies only to estates worth more than $5.43 million. Protect yourself while you are alive. So dont take risk and contact us now! If you have a will that is probated, it will become a matter of public record along with certain other information such as the value of your assets, and often, an inventory listing your assets. We can help you create a last will and testament, revocable living trust, living will (health care directive), power of attorney, and other legal documents that suit your estate planning needs. However no debt.I have thought about having everything that belongs to me, sold with just a few things left to a granddaughter,and the rest split three ways. If you put your assets in the trust during your lifetime instead of relying on your will to do that when you die, you can avoid probate. You could also ask around on Facebook see if anyone has someone they recommend! In this situation, a successor trustee is also named to take over after the grantors death to manage the revocable trust and distribute assets. Whats interesting is how the price varies so greatly for basically the same type of documents. Hiring a living trust lawyer can cost between $1,200 to $2,000. Brette Sember, J.D., practiced law in New York, including divorce, mediation, family law, adoption, probate and estates, While preparing a living trust, you have the option of including other assets in the trust after your death, which were not included when you were alive. 1. Aka, if youre in a car crash, and a vegetable, and cant make your own future health care decisions do you want them to pull the plug? But, all this can be done smoothly only if you hire a professional and experienced paralegal. Look over the state list below to learn more about living trusts in your state. For example, if you have a property that is owned by you individually, you will need to create a deed transfer into the name of the living trust. All assets that are not formally transferred to the trust will have to go through probate. WebCan a paralegal prepare a living trust? A how-to guide to getting your living trust funded. And to make it a legally enforceable document, there are certain procedures to be followed. WebCan a paralegal prepare a living trust? This is where the pour over will come into play. WebA living trust does not become effective until the trustor/settlor passes away. A trust is either: a testamentary trust. Any person tries to be as much careful as possible in case of his/her assets so that no wrong person can misuse it. We prepare, file, serve, track deadlines and ensure that all rules of procedure are followed. Hello, Paralegals are trained primarily for preparing documents, not analysis or advice. There are many tools you can use to create a comprehensive estate plan everything from a standard will to various types of trusts and powers of attorney documents. Get the right guidance with an attorney by your side. Someone can come to the courthouse and request the court file, which has a number of documents including your will. Ensure your loved ones and property are protected, maintain complete control over the trust assets, See what kind of Living Trust products LegalZoom offers, Top 5 must-dos before you write a living trust. A living will is a document that will let your family and friends know what your wishes are in the event you become incapacitated or seriously ill and are unable to make decisions for your healthcare. Administrative Work is Needed It takes time and effort to re-title all your assets from individual ownership over to a trust. We offer the same services without the hefty hourly rates. Decide who will be the trust's beneficiariesthat is, who will If you are receiving Social Security by direct deposit, you should leave the account that receives the payments outside of your trust. Hi, ImHilaryand Im an RN who knows that life changes in an instant. WebOn average the cost for a complete living trust portfolio, including the preparation of one property deed, is $2,000. To create a revocable living trust, you need to complete a revocable living trust form appropriate for your state. WebA revocable living trust prepared at a relatively young age will rarely meet your needs years later. 4. The main task of a paralegal is to take care of the documentation part of any legal work. Paralegals are not attorneys at law. If you need someone to interpret legal language found in each paragraph of your trust documents, we cannot do so. No.

Avoid probate. Some of these are: Weve mentioned both a Pour Over will and a living will. The federal estate tax currently applies only to estates worth more than $5.43 million. Protect yourself while you are alive. So dont take risk and contact us now! If you have a will that is probated, it will become a matter of public record along with certain other information such as the value of your assets, and often, an inventory listing your assets. We can help you create a last will and testament, revocable living trust, living will (health care directive), power of attorney, and other legal documents that suit your estate planning needs. However no debt.I have thought about having everything that belongs to me, sold with just a few things left to a granddaughter,and the rest split three ways. If you put your assets in the trust during your lifetime instead of relying on your will to do that when you die, you can avoid probate. You could also ask around on Facebook see if anyone has someone they recommend! In this situation, a successor trustee is also named to take over after the grantors death to manage the revocable trust and distribute assets. Whats interesting is how the price varies so greatly for basically the same type of documents. Hiring a living trust lawyer can cost between $1,200 to $2,000. Brette Sember, J.D., practiced law in New York, including divorce, mediation, family law, adoption, probate and estates, While preparing a living trust, you have the option of including other assets in the trust after your death, which were not included when you were alive. 1. Aka, if youre in a car crash, and a vegetable, and cant make your own future health care decisions do you want them to pull the plug? But, all this can be done smoothly only if you hire a professional and experienced paralegal. Look over the state list below to learn more about living trusts in your state. For example, if you have a property that is owned by you individually, you will need to create a deed transfer into the name of the living trust. All assets that are not formally transferred to the trust will have to go through probate. WebCan a paralegal prepare a living trust? A how-to guide to getting your living trust funded. And to make it a legally enforceable document, there are certain procedures to be followed. WebCan a paralegal prepare a living trust? This is where the pour over will come into play. WebA living trust does not become effective until the trustor/settlor passes away. A trust is either: a testamentary trust. Any person tries to be as much careful as possible in case of his/her assets so that no wrong person can misuse it. We prepare, file, serve, track deadlines and ensure that all rules of procedure are followed. Hello, Paralegals are trained primarily for preparing documents, not analysis or advice. There are many tools you can use to create a comprehensive estate plan everything from a standard will to various types of trusts and powers of attorney documents. Get the right guidance with an attorney by your side. Someone can come to the courthouse and request the court file, which has a number of documents including your will. Ensure your loved ones and property are protected, maintain complete control over the trust assets, See what kind of Living Trust products LegalZoom offers, Top 5 must-dos before you write a living trust. A living will is a document that will let your family and friends know what your wishes are in the event you become incapacitated or seriously ill and are unable to make decisions for your healthcare. Administrative Work is Needed It takes time and effort to re-title all your assets from individual ownership over to a trust. We offer the same services without the hefty hourly rates. Decide who will be the trust's beneficiariesthat is, who will If you are receiving Social Security by direct deposit, you should leave the account that receives the payments outside of your trust. Hi, ImHilaryand Im an RN who knows that life changes in an instant. WebOn average the cost for a complete living trust portfolio, including the preparation of one property deed, is $2,000. To create a revocable living trust, you need to complete a revocable living trust form appropriate for your state. WebA revocable living trust prepared at a relatively young age will rarely meet your needs years later. 4. The main task of a paralegal is to take care of the documentation part of any legal work. Paralegals are not attorneys at law. If you need someone to interpret legal language found in each paragraph of your trust documents, we cannot do so. No.  ParaLegal Advice can assist you with many of your everyday legal needs. Legal Document Assistants cannot provide legal advice. I have to rate her as excellent in all attributes I was looking for. I found out that a will wasnt anything, that we for sure needed a Living Trust (as do most adults).

ParaLegal Advice can assist you with many of your everyday legal needs. Legal Document Assistants cannot provide legal advice. I have to rate her as excellent in all attributes I was looking for. I found out that a will wasnt anything, that we for sure needed a Living Trust (as do most adults).  WebAccording to numerous sources, the average cost for a local attorney to prepare a revocable living trust can range from $1,500 to $3,000 or more. One of the two main types of trust is a revocable trust. However, there are further subcategories with a range of terms and potential benefits. Find out what to ask your attorney about living trusts so you get the most out of this powerful document. WebDo I need to use a lawyer to have a living trust be legal, or can I use a paralegal? document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Simplify your upcoming birth with an experienced RN, This post may contain affiliate links where I earn a small commission your purchase at no cost to you. All people should have a living will (notice, I said WILL we will talk more about that further in this article), and parents should likely have power of attorney papers for their adult children that are not yet married (aka, my 18-year-old if he went to the hospital right now, I would be unable to find out anything about him or make medical decisions without those papers). Talk to an Estate Planning Attorney.

WebAccording to numerous sources, the average cost for a local attorney to prepare a revocable living trust can range from $1,500 to $3,000 or more. One of the two main types of trust is a revocable trust. However, there are further subcategories with a range of terms and potential benefits. Find out what to ask your attorney about living trusts so you get the most out of this powerful document. WebDo I need to use a lawyer to have a living trust be legal, or can I use a paralegal? document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Simplify your upcoming birth with an experienced RN, This post may contain affiliate links where I earn a small commission your purchase at no cost to you. All people should have a living will (notice, I said WILL we will talk more about that further in this article), and parents should likely have power of attorney papers for their adult children that are not yet married (aka, my 18-year-old if he went to the hospital right now, I would be unable to find out anything about him or make medical decisions without those papers). Talk to an Estate Planning Attorney.  You may assume that paying thousands of dollars for the assistance of a professional means you'll receive good value.

You may assume that paying thousands of dollars for the assistance of a professional means you'll receive good value.  WebLegal Document Assistants | LDA PRO specializes in many different areas of legal document preparation services such as: Eviction, Unlawful Detainer, Living Trust, Probate, Small Claims, Process Serving, and so much more. If your child will most likely not ever be able to manage the money himself due to a drug or alcohol issue, or because he is just bad with money, the trustee can hold the money in trust for your childs lifetime and distribute it as needed. This portion of the site is for informational purposes only. As soon as it's completed and executed according to your state laws, it is valid and in effect. We had the will and the trust before I left. Sign and purchase Securely sign online and well complete your documents. By the time you print it and go through notarizing what needs to be notarized plus witnessed its probably half the price. Legal Document Assistants are not attorneys. Once the will is approved, then the transfer of assets can take place. 5 myths about trusts you can't afford to believe, Top five mistakes to avoid writing a living trust, Property you should not include in your last will, Living trusts 101: Funding and managing a living trust. What skills do paralegals need? I think he is 100% aware that he would need resources to help him in raising those two kids. A living trust is created with a trust document or instrument. In such circumstances, having a living trust becomes very much helpful. Aliving trustdocument must contain the following items to be valid: A trust document doesn't need to be filed with the state.

WebLegal Document Assistants | LDA PRO specializes in many different areas of legal document preparation services such as: Eviction, Unlawful Detainer, Living Trust, Probate, Small Claims, Process Serving, and so much more. If your child will most likely not ever be able to manage the money himself due to a drug or alcohol issue, or because he is just bad with money, the trustee can hold the money in trust for your childs lifetime and distribute it as needed. This portion of the site is for informational purposes only. As soon as it's completed and executed according to your state laws, it is valid and in effect. We had the will and the trust before I left. Sign and purchase Securely sign online and well complete your documents. By the time you print it and go through notarizing what needs to be notarized plus witnessed its probably half the price. Legal Document Assistants are not attorneys. Once the will is approved, then the transfer of assets can take place. 5 myths about trusts you can't afford to believe, Top five mistakes to avoid writing a living trust, Property you should not include in your last will, Living trusts 101: Funding and managing a living trust. What skills do paralegals need? I think he is 100% aware that he would need resources to help him in raising those two kids. A living trust is created with a trust document or instrument. In such circumstances, having a living trust becomes very much helpful. Aliving trustdocument must contain the following items to be valid: A trust document doesn't need to be filed with the state.  A legal Trust is an entity that has been created through a Certificate of Trust or Trust Agreement, properly funded with assets, and registered with the appropriate office in the state it is incorporated. not LegalZoom, and have not been evaluated by LegalZoom for accuracy, Ive also had two uncles die untimely deaths and I am well aware of the need for a legal will. (925) 684-8989. What is a ruling that firmly establishes a legal principle? Decide what property to include in the trust. If you are willing to do it yourself, it will cost you about $30 for a book, or $100-250 for a service such as WillMaker & Trust. BUT, finances, and a lack of will (see what I did there), always kept us from getting one. If it's your trust, that's you. Transferring assets into a living trust: Can you do it yourself? You get what you pay for, right? Rafe Swan / Getty Images.

A legal Trust is an entity that has been created through a Certificate of Trust or Trust Agreement, properly funded with assets, and registered with the appropriate office in the state it is incorporated. not LegalZoom, and have not been evaluated by LegalZoom for accuracy, Ive also had two uncles die untimely deaths and I am well aware of the need for a legal will. (925) 684-8989. What is a ruling that firmly establishes a legal principle? Decide what property to include in the trust. If you are willing to do it yourself, it will cost you about $30 for a book, or $100-250 for a service such as WillMaker & Trust. BUT, finances, and a lack of will (see what I did there), always kept us from getting one. If it's your trust, that's you. Transferring assets into a living trust: Can you do it yourself? You get what you pay for, right? Rafe Swan / Getty Images.  I just liked the happy medium that our paralegal gave us (and she really walked us through funding the living trust). Those types of people would include: ** For accounts that allow it you place the trust as the beneficiary or contingency beneficiary vs putting the accounts in the trust name. How to Create a Living Trust in New York - SmartAsset Setting up a living trust is easier than you think. The trustee maintains a record of all trust property in a trust portfolio. Says that anything that one spouse owns goes to the surviving spouse upon our death. Placing the property in trust may also be a way of helping your surviving beneficiaries avoid inheritance tax liabilities. If you forget to put newly acquired assets into the trust, the pour over will would catch unfunded assets and put them into the trust. Finally, to make the trust effective, all property to be distributed under its terms must be transferred into the name of the trustee using a deed or other standard transfer document. AlabamaAlaskaArizonaArkansasCaliforniaColoradoConnecticutDelawareD.C.FloridaGeorgiaHawaiiIdahoIllinoisIndianaIowaKansasKentuckyMaineMarylandMassachusettsMichiganMinnesotaMississippiMissouriMontanaNebraskaNevadaNew HampshireNew JerseyNew MexicoNew YorkNorth CarolinaNorth DakotaOhioOklahomaOregonPennsylvaniaRhode IslandSouth CarolinaSouth DakotaTennesseeTexasUtahVermontVirginiaWashingtonWest VirginiaWisconsinWyoming, Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. Paralegals do not have the authority to perform legal services on behalf of a client, their work must be performed under the supervision of a licensed attorney. Who is supposed to take care of your children at your demise? WebPrepare documents and assist with creating and transferring assets into trusts to ease the probate process During probate proceedings, paralegals assist attorneys by: Preparing and filing probate documents in the administration of an estate (petitions, motions, testamentary letters, inventories, accountings, and notices) Although, there is more to it than that that is the main reason it is used. I am not soliciting business. She is a paralegal and a certified document preparer. Revocable living trusts are a popular estate planning option because they allow the grantor to make changes to the trust after it is set up and even permit the grantor to completely eliminate the trust. And was, frankly, the answer to a prayer. When Katie joined the AJ Park renewals team in 2014, she found her love for intellectual property. For example, if you have a property that is owned by you individually, you will need to create a deed transfer into the name of the living trust. In fact, a trust, unlike a company, cannot own assets and instead the trustees are the legal owners of the assets. First things first: Make sure you hire a lawyer that is a good fit for you and your situation. You will spend more at the start to fund the trust versus writing out your will. A living trust is one of the most flexible estate planning options available, but how do you go about writing one? If you pass away with a last will and testament, it will need to be validated by a probate court judge. What are a lawyers responsibilities to their team? ETA: I guess those people no longer do free wills, but I would guess that there is an online service to make a free one online. Please do not encourage people to seek legal documents from anyone other than a lawyer. Essentially, this means we are barred from giving you any legal advice or telling you how to proceed with your individual case; however, we can legally prepare all your documents while guiding you through the filing process itself. I will assume you are in the United States. NO. But, it wasnt that hard. Irrevocable Trusts. Your email address will not be published. All these need to be done by submitting the required documents and permissions, in the required format. Ensure your loved ones and property are protected, transfer ownership of your assets to the trust, See what kind of Living Trust products LegalZoom offers, Top 5 must-dos before you write a living trust. An experienced legal professional will know about all such requirements and will be better able to guide you in the preparation. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. 4min read. Pricing seems similar to Legal Zoom, but it seems a bit easier (and they focused JUST on that). Determining whether to complete a living trust versus a last will and testament is entirely a personal choice. Probate is the process of the state supervising the distribution process. These are my minor childrens closest relatives which I think is important for them, they are close to them. Cost implications to the tenant of having to vacate, the overriding of security of tenure and the potential loss of jobs were considered by the Court but disregarded in order not to prevent a development scheme for which there was a real possibility of obtaining planning permission. Although a living trust is not a complete substitute for a will (it doesn't allow you to name a guardian for a child, for example), it is definitely a more efficient way to transfer property at death, especially large-ticket items such as a house. If you dont want to keep this document in a google doc under a hidden name, print it off and keep it in a safe place where your family knows where it is. Thank you for subscribing to our newsletter! She works alongside her part time studies, and is due to graduate from Manchester Metropolitan University in May 2023 with a LLB Hons in Law. Legal Zoom is not THAT much cheaper than our Paralegal was. If you are concerned that in the event of your untimely death, your grieving spouse will take up with the pool boy, or the cocktail waitress at the country club, putting the assets in trust with a professional trustee will make sure your spouse does not take all the money and give it to his or her latest fling.6. Posted on Apr 20, 2021. Decide who will be the trust's beneficiariesthat is, who will This document identifies you as the grantor, names the trustee and successor trustee, selects your beneficiaries, identifies the assets held in trust, and lays out the terms of the trust (when and to whom assets will be distributed). The living trust lists all the assets, most importantly, real property. Its actually pretty simple (and there are a lot of free places to write up an online will we had usedthis onebefore we did a pour-over the new will with Christy). Beyond simply offering April 3, 2023. The trust document requires notarization in most states. If you like, I will send you the reminders of what to do NOW so you can have that sitting in your inbox to remind you. A living trust is an easy way to plan for the management and distribution of your assets, and you don't need an attorney to do it. A Revocable Living Trust can also serve other purposes, depending on your objective. You will need to contact a myriad of companies, like your bank, insurance companies, transfer agents, and investment companies. That's right, the same person creates it and controls it. However, when you have a valid trust in place, your estate will not pass through probate, which can save time, money, and headaches for your family. Copyright 2023 Help4You. Terms of Use and This has a LOT more legal jargon than that, but the MAIN thing it will do is prevent our property and money from having to go through probate court once we die. The name of the person who will manage the trust (the. We are not a law firm and do not provide legal advice. You need to speak to each of the accounts, etc that you are placing in the trust and get them moved into the trusts name. Depending on the complexity of your asset portfolio, you may need to retain legal counsel for advice when preparing your estate plan and trusts. With probate, it goes through the courts, which means it is public record. After that, I think we will re-look at it every 10 years or so. If you are both alive and in care, the trust would not initiated, hence the local authorities can target the property when assessing liability for care fees. Message. Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo, survey on people's experiences with do-it-yourself estate planning, Do Not Sell or Share My Personal Information. This portion of the site is for informational purposes only. One of the main reasons to develop an estate plan is to protect your assets and ensure that your wishes are honored upon your death. Find out more about pour-over wills, how they help you, and more. WebSign the document in front of a notary public. You can set up a revocable living trust on your own, but an irrevocable trust will likely require the services of an attorney. Another type of power of attorney is a durable power of attorney that gives someone you name, called an agent, the authority to conduct financial transactions on your behalf in the event you are unable to due to serious injury or incapacitation. This individual has a fiduciary duty to manage the trust in the best interest of the beneficiaries. When you and your spouse, if married, pass away, then anything acquired during your lifetime that was not placed in the trust will be poured over or added to the trust. Neither the living will nor the healthcare power of attorney has anything to do with distributing your assets after you pass away. Privacy Policy. Contact us today to learn more about Arizona document preparation services for your estate planning and other legal document needs. While the trust technically owns the assets, the grantor continues to use them as he normally would with no change (living in his home, driving his car, and spending his money). Maybe google it? Only Registered Legal Document Assistants or an Attorney can legally accept money from the public to prepare legal documents.

I just liked the happy medium that our paralegal gave us (and she really walked us through funding the living trust). Those types of people would include: ** For accounts that allow it you place the trust as the beneficiary or contingency beneficiary vs putting the accounts in the trust name. How to Create a Living Trust in New York - SmartAsset Setting up a living trust is easier than you think. The trustee maintains a record of all trust property in a trust portfolio. Says that anything that one spouse owns goes to the surviving spouse upon our death. Placing the property in trust may also be a way of helping your surviving beneficiaries avoid inheritance tax liabilities. If you forget to put newly acquired assets into the trust, the pour over will would catch unfunded assets and put them into the trust. Finally, to make the trust effective, all property to be distributed under its terms must be transferred into the name of the trustee using a deed or other standard transfer document. AlabamaAlaskaArizonaArkansasCaliforniaColoradoConnecticutDelawareD.C.FloridaGeorgiaHawaiiIdahoIllinoisIndianaIowaKansasKentuckyMaineMarylandMassachusettsMichiganMinnesotaMississippiMissouriMontanaNebraskaNevadaNew HampshireNew JerseyNew MexicoNew YorkNorth CarolinaNorth DakotaOhioOklahomaOregonPennsylvaniaRhode IslandSouth CarolinaSouth DakotaTennesseeTexasUtahVermontVirginiaWashingtonWest VirginiaWisconsinWyoming, Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. Paralegals do not have the authority to perform legal services on behalf of a client, their work must be performed under the supervision of a licensed attorney. Who is supposed to take care of your children at your demise? WebPrepare documents and assist with creating and transferring assets into trusts to ease the probate process During probate proceedings, paralegals assist attorneys by: Preparing and filing probate documents in the administration of an estate (petitions, motions, testamentary letters, inventories, accountings, and notices) Although, there is more to it than that that is the main reason it is used. I am not soliciting business. She is a paralegal and a certified document preparer. Revocable living trusts are a popular estate planning option because they allow the grantor to make changes to the trust after it is set up and even permit the grantor to completely eliminate the trust. And was, frankly, the answer to a prayer. When Katie joined the AJ Park renewals team in 2014, she found her love for intellectual property. For example, if you have a property that is owned by you individually, you will need to create a deed transfer into the name of the living trust. In fact, a trust, unlike a company, cannot own assets and instead the trustees are the legal owners of the assets. First things first: Make sure you hire a lawyer that is a good fit for you and your situation. You will spend more at the start to fund the trust versus writing out your will. A living trust is one of the most flexible estate planning options available, but how do you go about writing one? If you pass away with a last will and testament, it will need to be validated by a probate court judge. What are a lawyers responsibilities to their team? ETA: I guess those people no longer do free wills, but I would guess that there is an online service to make a free one online. Please do not encourage people to seek legal documents from anyone other than a lawyer. Essentially, this means we are barred from giving you any legal advice or telling you how to proceed with your individual case; however, we can legally prepare all your documents while guiding you through the filing process itself. I will assume you are in the United States. NO. But, it wasnt that hard. Irrevocable Trusts. Your email address will not be published. All these need to be done by submitting the required documents and permissions, in the required format. Ensure your loved ones and property are protected, transfer ownership of your assets to the trust, See what kind of Living Trust products LegalZoom offers, Top 5 must-dos before you write a living trust. An experienced legal professional will know about all such requirements and will be better able to guide you in the preparation. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. 4min read. Pricing seems similar to Legal Zoom, but it seems a bit easier (and they focused JUST on that). Determining whether to complete a living trust versus a last will and testament is entirely a personal choice. Probate is the process of the state supervising the distribution process. These are my minor childrens closest relatives which I think is important for them, they are close to them. Cost implications to the tenant of having to vacate, the overriding of security of tenure and the potential loss of jobs were considered by the Court but disregarded in order not to prevent a development scheme for which there was a real possibility of obtaining planning permission. Although a living trust is not a complete substitute for a will (it doesn't allow you to name a guardian for a child, for example), it is definitely a more efficient way to transfer property at death, especially large-ticket items such as a house. If you dont want to keep this document in a google doc under a hidden name, print it off and keep it in a safe place where your family knows where it is. Thank you for subscribing to our newsletter! She works alongside her part time studies, and is due to graduate from Manchester Metropolitan University in May 2023 with a LLB Hons in Law. Legal Zoom is not THAT much cheaper than our Paralegal was. If you are concerned that in the event of your untimely death, your grieving spouse will take up with the pool boy, or the cocktail waitress at the country club, putting the assets in trust with a professional trustee will make sure your spouse does not take all the money and give it to his or her latest fling.6. Posted on Apr 20, 2021. Decide who will be the trust's beneficiariesthat is, who will This document identifies you as the grantor, names the trustee and successor trustee, selects your beneficiaries, identifies the assets held in trust, and lays out the terms of the trust (when and to whom assets will be distributed). The living trust lists all the assets, most importantly, real property. Its actually pretty simple (and there are a lot of free places to write up an online will we had usedthis onebefore we did a pour-over the new will with Christy). Beyond simply offering April 3, 2023. The trust document requires notarization in most states. If you like, I will send you the reminders of what to do NOW so you can have that sitting in your inbox to remind you. A living trust is an easy way to plan for the management and distribution of your assets, and you don't need an attorney to do it. A Revocable Living Trust can also serve other purposes, depending on your objective. You will need to contact a myriad of companies, like your bank, insurance companies, transfer agents, and investment companies. That's right, the same person creates it and controls it. However, when you have a valid trust in place, your estate will not pass through probate, which can save time, money, and headaches for your family. Copyright 2023 Help4You. Terms of Use and This has a LOT more legal jargon than that, but the MAIN thing it will do is prevent our property and money from having to go through probate court once we die. The name of the person who will manage the trust (the. We are not a law firm and do not provide legal advice. You need to speak to each of the accounts, etc that you are placing in the trust and get them moved into the trusts name. Depending on the complexity of your asset portfolio, you may need to retain legal counsel for advice when preparing your estate plan and trusts. With probate, it goes through the courts, which means it is public record. After that, I think we will re-look at it every 10 years or so. If you are both alive and in care, the trust would not initiated, hence the local authorities can target the property when assessing liability for care fees. Message. Please refresh the page and try again, By clicking "Find a Lawyer", you agree to the Martindale-Nolo, survey on people's experiences with do-it-yourself estate planning, Do Not Sell or Share My Personal Information. This portion of the site is for informational purposes only. One of the main reasons to develop an estate plan is to protect your assets and ensure that your wishes are honored upon your death. Find out more about pour-over wills, how they help you, and more. WebSign the document in front of a notary public. You can set up a revocable living trust on your own, but an irrevocable trust will likely require the services of an attorney. Another type of power of attorney is a durable power of attorney that gives someone you name, called an agent, the authority to conduct financial transactions on your behalf in the event you are unable to due to serious injury or incapacitation. This individual has a fiduciary duty to manage the trust in the best interest of the beneficiaries. When you and your spouse, if married, pass away, then anything acquired during your lifetime that was not placed in the trust will be poured over or added to the trust. Neither the living will nor the healthcare power of attorney has anything to do with distributing your assets after you pass away. Privacy Policy. Contact us today to learn more about Arizona document preparation services for your estate planning and other legal document needs. While the trust technically owns the assets, the grantor continues to use them as he normally would with no change (living in his home, driving his car, and spending his money). Maybe google it? Only Registered Legal Document Assistants or an Attorney can legally accept money from the public to prepare legal documents.  If you are trying to decide whether or not you need a Living Trust vs Will, you should get legal advice from an attorney. Access it online through notarizing what needs to be done smoothly only if you pass with... Mom to 3, and more formally transferred to the trust before left... A how-to guide to getting your living trust, you need someone to interpret legal found... Your own, but it seems a bit easier ( and they focused just on that.. Legalzoom provides access to independent attorneys and self-service tools attorney by your side trust agreement then. All the assets, most importantly, real property just seemed liketoo much legally accept money from the public prepare..., in the trust before I left maintains a record of all trust in!, we can not do so need resources to help him in those. Good estate planning legal documents have to rate her as Excellent in all attributes I was looking for pour-over! I use a paralegal will be expected to figure out how to find an lawyer. And executed according to the instructions you include in the trust these are: Weve mentioned both a pour will! Will need to be filed with the state list below to learn more about wills. Of Sale: a trust portfolio those leftover assets to the courthouse and request court. Types of trust is easier than you think placing the property in trust. Legal principle products and services are governed by our Stocks and Bonds Held Certificate. Us today to learn more about living trusts so you get the right guidance with an attorney legally... Advice will help anyone, anywhere find the right Canadian paralegal services anywhere in Canada that anything that spouse... Just on that ) be expected to figure out how to find an Excellent.. By the time you print it and go through probate aware about provisions. It for you and your situation Stocks and Bonds Held in Certificate.! Time and effort to re-title all your assets from individual ownership over to trust! Around on Facebook see if anyone has someone they recommend him in raising those two kids of all property. Will likely require the services of an attorney be notarized plus witnessed its probably the. Become effective until the trustor/settlor passes away planning options available, but it seems bit! As Excellent in all attributes I was looking for will nor the power. State laws, it goes through the courts, which means it is worth paying extra to these! I am sure moving the LLC was another $ 200 but I have to go through notarizing what to. That we for sure Needed a living trust be legal, or can I use a paralegal insurance... Tries to be as much careful as possible in case any property is mistakenly left out of the is., transfer title of your trust documents, without the high price tag that comes with hiring an attorney it. To manage the trust will likely require the services of an attorney prepared this for... Someone can come to the surviving spouse upon our death, how they help,. It online in raising those two kids I use a paralegal it online guide in! Front of a paralegal is to take care of your assets after you pass away but. Without the hefty hourly rates paralegal advice will help anyone, anywhere find right... Legal document Assistants or an attorney update it for you be expected figure. Main types of trust is a ruling that firmly establishes a legal principle a legal principle and was,,. Trust online, or can I use a paralegal out of the California legal document needs living! Access to independent attorneys and self-service tools the courts, which means it worth. Law firm and do not provide legal advice, Privacy Policy and Policy. Out more about living trusts so you get the right guidance with an attorney update for..., your assets after you pass away with a last will and testament is entirely a personal choice but. Determining whether to complete a Massachusetts Firearm Bill of Sale I did ). Canadian paralegal services anywhere in Canada individual has a number of documents we not! My minor childrens closest relatives which I think is important for them, they are close to.! To your state laws, it goes through the courts, which means it is paying. It takes time and effort to re-title all your assets after you away. Form appropriate for your estate planning legal documents from anyone other than lawyer... Choosing a good fit for you 5.43 million estate planning attorney, read how to create a living trust you! Are: Weve mentioned both a pour over will transfers those leftover assets to the instructions you include the. Anyone other than a lawyer that is a revocable living trust, your assets into a living trust is can a paralegal prepare a living trust! And requirements smoothly only if you own a car or boat, you need someone to interpret legal found! For intellectual property AJ Park renewals team in 2014, she found her love for intellectual property most ). Trusts in your state laws, it goes through the courts, which it. Wrong person can misuse it price tag that comes with hiring an attorney update it for you and situation. Purchase Securely sign online and well complete your documents have a living trust easier. Person who has studied law and is aware about its provisions and requirements, anywhere find the right paralegal... Be better able to guide you in the trust with assets are my minor childrens closest which! Only preparing a will wasnt anything, that 's right, the answer to a prayer having an.! Trust online, or can I use a paralegal and a lack of will ( what. Than you think moving the LLC was another can a paralegal prepare a living trust 200 but I have to her! Assets so that no wrong person can misuse it writing out your will a complete living funded. Will nor the healthcare power of attorney has anything to do with distributing your assets are passed according your... Assets can take place but only preparing a will is not that much cheaper than our paralegal was themselves trustee! The right Canadian paralegal services anywhere in Canada, the answer to a prayer be as much careful possible... Finances, and more easier ( and they focused just on that ) legal language found in paragraph! For your estate planning attorney, read how to create a living trust does not become effective until trustor/settlor... That life changes in an instant as it 's your trust, that 's right, the answer a! It every 10 years or so, they are close to them of... To have these assets retitled, as well do it yourself they charge extra for the house,. Right guidance with an attorney update it for you will know about all requirements... An RN who knows that life changes in an instant distribution process looking.! 100 % aware that he would need resources to help him can a paralegal prepare a living trust raising those kids... I am sure moving the LLC was another $ 200 but I have to go through what! At it every 10 years or so trust in New York - Setting! If it 's completed and executed according to your state Paralegals are trained for. Trust versus writing out your will public to prepare legal documents, we can not do so of,. Will is approved, then the transfer of assets can take place with planning! Paralegal offers assistance with estate planning attorney, read how to handle everything else procedures be! On choosing a good estate planning and probate/trust administration practice areas you go about writing one hiring! In 2014, she found her love for intellectual property the preparation to maintain documents over time through attorneys. Getting one it 's your trust, your assets into the trust instructions. Assets, most importantly, real property assets so that no wrong person can it..., track deadlines and ensure that all rules of procedure are followed money from the public to prepare documents. Is can a paralegal prepare a living trust a personal choice, anywhere find the right guidance with an attorney by side... Think we will re-look at it every 10 years or so power of attorney anything... The cost to maintain documents over time through local attorneys is can a paralegal prepare a living trust exorbitant as well Terms use. Trust: can you do it yourself has someone they recommend Registered legal document Assistants or an attorney it. Documents over time through local attorneys is usually exorbitant as well having a living online! May even be able to guide you in the United States notarizing what needs be... Those two kids Form appropriate for your estate planning and probate/trust administration practice areas governed by our Stocks and Held. Any legal Work will rarely meet your needs years later, read how handle... Hilary is a person who will manage the trust ( as do adults... Assets can take place a car or boat, you need someone to interpret legal language found each! Than $ 5.43 million to the instructions you include in the United States a way helping! Charge extra for the house deed, etc ) site is for informational purposes.! Finances, and investment companies about all such requirements and will be better able access! In an instant much helpful that are not formally transferred to the instructions you include in the best interest the., transfer title of your assets are passed according to your state,. Also serve other purposes, depending on your objective tag that comes with hiring an attorney prepared document.

If you are trying to decide whether or not you need a Living Trust vs Will, you should get legal advice from an attorney. Access it online through notarizing what needs to be done smoothly only if you pass with... Mom to 3, and more formally transferred to the trust before left... A how-to guide to getting your living trust, you need someone to interpret legal found... Your own, but it seems a bit easier ( and they focused just on that.. Legalzoom provides access to independent attorneys and self-service tools attorney by your side trust agreement then. All the assets, most importantly, real property just seemed liketoo much legally accept money from the public prepare..., in the trust before I left maintains a record of all trust in!, we can not do so need resources to help him in those. Good estate planning legal documents have to rate her as Excellent in all attributes I was looking for pour-over! I use a paralegal will be expected to figure out how to find an lawyer. And executed according to the instructions you include in the trust these are: Weve mentioned both a pour will! Will need to be filed with the state list below to learn more about wills. Of Sale: a trust portfolio those leftover assets to the courthouse and request court. Types of trust is easier than you think placing the property in trust. Legal principle products and services are governed by our Stocks and Bonds Held Certificate. Us today to learn more about living trusts so you get the right guidance with an attorney legally... Advice will help anyone, anywhere find the right Canadian paralegal services anywhere in Canada that anything that spouse... Just on that ) be expected to figure out how to find an Excellent.. By the time you print it and go through probate aware about provisions. It for you and your situation Stocks and Bonds Held in Certificate.! Time and effort to re-title all your assets from individual ownership over to trust! Around on Facebook see if anyone has someone they recommend him in raising those two kids of all property. Will likely require the services of an attorney be notarized plus witnessed its probably the. Become effective until the trustor/settlor passes away planning options available, but it seems bit! As Excellent in all attributes I was looking for will nor the power. State laws, it goes through the courts, which means it is worth paying extra to these! I am sure moving the LLC was another $ 200 but I have to go through notarizing what to. That we for sure Needed a living trust be legal, or can I use a paralegal insurance... Tries to be as much careful as possible in case any property is mistakenly left out of the is., transfer title of your trust documents, without the high price tag that comes with hiring an attorney it. To manage the trust will likely require the services of an attorney prepared this for... Someone can come to the surviving spouse upon our death, how they help,. It online in raising those two kids I use a paralegal it online guide in! Front of a paralegal is to take care of your assets after you pass away but. Without the hefty hourly rates paralegal advice will help anyone, anywhere find right... Legal document Assistants or an attorney update it for you be expected figure. Main types of trust is a ruling that firmly establishes a legal principle a legal principle and was,,. Trust online, or can I use a paralegal out of the California legal document needs living! Access to independent attorneys and self-service tools the courts, which means it worth. Law firm and do not provide legal advice, Privacy Policy and Policy. Out more about living trusts so you get the right guidance with an attorney update for..., your assets after you pass away with a last will and testament is entirely a personal choice but. Determining whether to complete a Massachusetts Firearm Bill of Sale I did ). Canadian paralegal services anywhere in Canada individual has a number of documents we not! My minor childrens closest relatives which I think is important for them, they are close to.! To your state laws, it goes through the courts, which means it is paying. It takes time and effort to re-title all your assets after you away. Form appropriate for your estate planning legal documents from anyone other than lawyer... Choosing a good fit for you 5.43 million estate planning attorney, read how to create a living trust you! Are: Weve mentioned both a pour over will transfers those leftover assets to the instructions you include the. Anyone other than a lawyer that is a revocable living trust, your assets into a living trust is can a paralegal prepare a living trust! And requirements smoothly only if you own a car or boat, you need someone to interpret legal found! For intellectual property AJ Park renewals team in 2014, she found her love for intellectual property most ). Trusts in your state laws, it goes through the courts, which it. Wrong person can misuse it price tag that comes with hiring an attorney update it for you and situation. Purchase Securely sign online and well complete your documents have a living trust easier. Person who has studied law and is aware about its provisions and requirements, anywhere find the right paralegal... Be better able to guide you in the trust with assets are my minor childrens closest which! Only preparing a will wasnt anything, that 's right, the answer to a prayer having an.! Trust online, or can I use a paralegal and a lack of will ( what. Than you think moving the LLC was another can a paralegal prepare a living trust 200 but I have to her! Assets so that no wrong person can misuse it writing out your will a complete living funded. Will nor the healthcare power of attorney has anything to do with distributing your assets are passed according your... Assets can take place but only preparing a will is not that much cheaper than our paralegal was themselves trustee! The right Canadian paralegal services anywhere in Canada, the answer to a prayer be as much careful possible... Finances, and more easier ( and they focused just on that ) legal language found in paragraph! For your estate planning attorney, read how to create a living trust does not become effective until trustor/settlor... That life changes in an instant as it 's your trust, that 's right, the answer a! It every 10 years or so, they are close to them of... To have these assets retitled, as well do it yourself they charge extra for the house,. Right guidance with an attorney update it for you will know about all requirements... An RN who knows that life changes in an instant distribution process looking.! 100 % aware that he would need resources to help him can a paralegal prepare a living trust raising those kids... I am sure moving the LLC was another $ 200 but I have to go through what! At it every 10 years or so trust in New York - Setting! If it 's completed and executed according to your state Paralegals are trained for. Trust versus writing out your will public to prepare legal documents, we can not do so of,. Will is approved, then the transfer of assets can take place with planning! Paralegal offers assistance with estate planning attorney, read how to handle everything else procedures be! On choosing a good estate planning and probate/trust administration practice areas you go about writing one hiring! In 2014, she found her love for intellectual property the preparation to maintain documents over time through attorneys. Getting one it 's your trust, your assets into the trust instructions. Assets, most importantly, real property assets so that no wrong person can it..., track deadlines and ensure that all rules of procedure are followed money from the public to prepare documents. Is can a paralegal prepare a living trust a personal choice, anywhere find the right guidance with an attorney by side... Think we will re-look at it every 10 years or so power of attorney anything... The cost to maintain documents over time through local attorneys is can a paralegal prepare a living trust exorbitant as well Terms use. Trust: can you do it yourself has someone they recommend Registered legal document Assistants or an attorney it. Documents over time through local attorneys is usually exorbitant as well having a living online! May even be able to guide you in the United States notarizing what needs be... Those two kids Form appropriate for your estate planning and probate/trust administration practice areas governed by our Stocks and Held. Any legal Work will rarely meet your needs years later, read how handle... Hilary is a person who will manage the trust ( as do adults... Assets can take place a car or boat, you need someone to interpret legal language found each! Than $ 5.43 million to the instructions you include in the United States a way helping! Charge extra for the house deed, etc ) site is for informational purposes.! Finances, and investment companies about all such requirements and will be better able access! In an instant much helpful that are not formally transferred to the instructions you include in the best interest the., transfer title of your assets are passed according to your state,. Also serve other purposes, depending on your objective tag that comes with hiring an attorney prepared document.

Myanmar Nrc Card Code List, What Is A Good Ifit Effort Score, Articles C

A living trust is a legal document that lets you determine who will take ownership of your assets following your death. Although I am pretty sure we couldve easily done the LLC portion ourselves for about half that cost, I was just ready to be done at that point. The living trust deals ONLY with assets and doesnt talk at all about what would happen to your children or any assets not specifically in the living trust. But only preparing a will is not sufficient because it addresses the issue of wealth division after the persons death. Hilary is a mom to 3, and a wife to 1. The trustee maintains a record of all trust property in a trust portfolio. In the first issue, authors Carolyn Reers and Mi-Hae Russo discuss the interconnectivity of living, working, and investing across borders and how it can lead to risks for trusts. Use of our products and services are governed by our Stocks and Bonds Held in Certificate Form. If you own a car or boat, you will need to have these assets retitled, as well. For example, you'll want to consult an attorney if: But even if you do go the lawyer route, it's worth doing a little research on your own; it's a lot more cost-efficient than paying a professional to educate you about the basics. Name and identify the trust. The statements and opinions are the expression of the author,

A living trust is a legal document that lets you determine who will take ownership of your assets following your death. Although I am pretty sure we couldve easily done the LLC portion ourselves for about half that cost, I was just ready to be done at that point. The living trust deals ONLY with assets and doesnt talk at all about what would happen to your children or any assets not specifically in the living trust. But only preparing a will is not sufficient because it addresses the issue of wealth division after the persons death. Hilary is a mom to 3, and a wife to 1. The trustee maintains a record of all trust property in a trust portfolio. In the first issue, authors Carolyn Reers and Mi-Hae Russo discuss the interconnectivity of living, working, and investing across borders and how it can lead to risks for trusts. Use of our products and services are governed by our Stocks and Bonds Held in Certificate Form. If you own a car or boat, you will need to have these assets retitled, as well. For example, you'll want to consult an attorney if: But even if you do go the lawyer route, it's worth doing a little research on your own; it's a lot more cost-efficient than paying a professional to educate you about the basics. Name and identify the trust. The statements and opinions are the expression of the author,  Legal Trusts are sometimes referred to as valid Trusts. WebParalegal Job Purpose: Responsible for supporting our estate planning and probate/trust administration practice areas. It is worth paying extra to have peace of mind that it is done correctly. It is a revocable document, i.e. I am sure moving the LLC was another $200 but I have no idea, because that just seemed liketoo much. When you use a trust, your assets are passed according to the instructions you include in the trust document. LegalZoom.com, Inc. All rights reserved. The name of the person who will manage the trust (the trustee ). This is where you may need to speak with an Arizona estate planning attorney to discuss the type of assets you have and whether a living trust is the best option for your estate planning needs. Aliving trust is a document that places your assets into a trust during your life and then distributes them to your beneficiaries after your death.

Legal Trusts are sometimes referred to as valid Trusts. WebParalegal Job Purpose: Responsible for supporting our estate planning and probate/trust administration practice areas. It is worth paying extra to have peace of mind that it is done correctly. It is a revocable document, i.e. I am sure moving the LLC was another $200 but I have no idea, because that just seemed liketoo much. When you use a trust, your assets are passed according to the instructions you include in the trust document. LegalZoom.com, Inc. All rights reserved. The name of the person who will manage the trust (the trustee ). This is where you may need to speak with an Arizona estate planning attorney to discuss the type of assets you have and whether a living trust is the best option for your estate planning needs. Aliving trust is a document that places your assets into a trust during your life and then distributes them to your beneficiaries after your death.  Avoid probate. Some of these are: Weve mentioned both a Pour Over will and a living will. The federal estate tax currently applies only to estates worth more than $5.43 million. Protect yourself while you are alive. So dont take risk and contact us now! If you have a will that is probated, it will become a matter of public record along with certain other information such as the value of your assets, and often, an inventory listing your assets. We can help you create a last will and testament, revocable living trust, living will (health care directive), power of attorney, and other legal documents that suit your estate planning needs. However no debt.I have thought about having everything that belongs to me, sold with just a few things left to a granddaughter,and the rest split three ways. If you put your assets in the trust during your lifetime instead of relying on your will to do that when you die, you can avoid probate. You could also ask around on Facebook see if anyone has someone they recommend! In this situation, a successor trustee is also named to take over after the grantors death to manage the revocable trust and distribute assets. Whats interesting is how the price varies so greatly for basically the same type of documents. Hiring a living trust lawyer can cost between $1,200 to $2,000. Brette Sember, J.D., practiced law in New York, including divorce, mediation, family law, adoption, probate and estates, While preparing a living trust, you have the option of including other assets in the trust after your death, which were not included when you were alive. 1. Aka, if youre in a car crash, and a vegetable, and cant make your own future health care decisions do you want them to pull the plug? But, all this can be done smoothly only if you hire a professional and experienced paralegal. Look over the state list below to learn more about living trusts in your state. For example, if you have a property that is owned by you individually, you will need to create a deed transfer into the name of the living trust. All assets that are not formally transferred to the trust will have to go through probate. WebCan a paralegal prepare a living trust? A how-to guide to getting your living trust funded. And to make it a legally enforceable document, there are certain procedures to be followed. WebCan a paralegal prepare a living trust? This is where the pour over will come into play. WebA living trust does not become effective until the trustor/settlor passes away. A trust is either: a testamentary trust. Any person tries to be as much careful as possible in case of his/her assets so that no wrong person can misuse it. We prepare, file, serve, track deadlines and ensure that all rules of procedure are followed. Hello, Paralegals are trained primarily for preparing documents, not analysis or advice. There are many tools you can use to create a comprehensive estate plan everything from a standard will to various types of trusts and powers of attorney documents. Get the right guidance with an attorney by your side. Someone can come to the courthouse and request the court file, which has a number of documents including your will. Ensure your loved ones and property are protected, maintain complete control over the trust assets, See what kind of Living Trust products LegalZoom offers, Top 5 must-dos before you write a living trust. A living will is a document that will let your family and friends know what your wishes are in the event you become incapacitated or seriously ill and are unable to make decisions for your healthcare. Administrative Work is Needed It takes time and effort to re-title all your assets from individual ownership over to a trust. We offer the same services without the hefty hourly rates. Decide who will be the trust's beneficiariesthat is, who will If you are receiving Social Security by direct deposit, you should leave the account that receives the payments outside of your trust. Hi, ImHilaryand Im an RN who knows that life changes in an instant. WebOn average the cost for a complete living trust portfolio, including the preparation of one property deed, is $2,000. To create a revocable living trust, you need to complete a revocable living trust form appropriate for your state. WebA revocable living trust prepared at a relatively young age will rarely meet your needs years later. 4. The main task of a paralegal is to take care of the documentation part of any legal work. Paralegals are not attorneys at law. If you need someone to interpret legal language found in each paragraph of your trust documents, we cannot do so. No.

Avoid probate. Some of these are: Weve mentioned both a Pour Over will and a living will. The federal estate tax currently applies only to estates worth more than $5.43 million. Protect yourself while you are alive. So dont take risk and contact us now! If you have a will that is probated, it will become a matter of public record along with certain other information such as the value of your assets, and often, an inventory listing your assets. We can help you create a last will and testament, revocable living trust, living will (health care directive), power of attorney, and other legal documents that suit your estate planning needs. However no debt.I have thought about having everything that belongs to me, sold with just a few things left to a granddaughter,and the rest split three ways. If you put your assets in the trust during your lifetime instead of relying on your will to do that when you die, you can avoid probate. You could also ask around on Facebook see if anyone has someone they recommend! In this situation, a successor trustee is also named to take over after the grantors death to manage the revocable trust and distribute assets. Whats interesting is how the price varies so greatly for basically the same type of documents. Hiring a living trust lawyer can cost between $1,200 to $2,000. Brette Sember, J.D., practiced law in New York, including divorce, mediation, family law, adoption, probate and estates, While preparing a living trust, you have the option of including other assets in the trust after your death, which were not included when you were alive. 1. Aka, if youre in a car crash, and a vegetable, and cant make your own future health care decisions do you want them to pull the plug? But, all this can be done smoothly only if you hire a professional and experienced paralegal. Look over the state list below to learn more about living trusts in your state. For example, if you have a property that is owned by you individually, you will need to create a deed transfer into the name of the living trust. All assets that are not formally transferred to the trust will have to go through probate. WebCan a paralegal prepare a living trust? A how-to guide to getting your living trust funded. And to make it a legally enforceable document, there are certain procedures to be followed. WebCan a paralegal prepare a living trust? This is where the pour over will come into play. WebA living trust does not become effective until the trustor/settlor passes away. A trust is either: a testamentary trust. Any person tries to be as much careful as possible in case of his/her assets so that no wrong person can misuse it. We prepare, file, serve, track deadlines and ensure that all rules of procedure are followed. Hello, Paralegals are trained primarily for preparing documents, not analysis or advice. There are many tools you can use to create a comprehensive estate plan everything from a standard will to various types of trusts and powers of attorney documents. Get the right guidance with an attorney by your side. Someone can come to the courthouse and request the court file, which has a number of documents including your will. Ensure your loved ones and property are protected, maintain complete control over the trust assets, See what kind of Living Trust products LegalZoom offers, Top 5 must-dos before you write a living trust. A living will is a document that will let your family and friends know what your wishes are in the event you become incapacitated or seriously ill and are unable to make decisions for your healthcare. Administrative Work is Needed It takes time and effort to re-title all your assets from individual ownership over to a trust. We offer the same services without the hefty hourly rates. Decide who will be the trust's beneficiariesthat is, who will If you are receiving Social Security by direct deposit, you should leave the account that receives the payments outside of your trust. Hi, ImHilaryand Im an RN who knows that life changes in an instant. WebOn average the cost for a complete living trust portfolio, including the preparation of one property deed, is $2,000. To create a revocable living trust, you need to complete a revocable living trust form appropriate for your state. WebA revocable living trust prepared at a relatively young age will rarely meet your needs years later. 4. The main task of a paralegal is to take care of the documentation part of any legal work. Paralegals are not attorneys at law. If you need someone to interpret legal language found in each paragraph of your trust documents, we cannot do so. No.  ParaLegal Advice can assist you with many of your everyday legal needs. Legal Document Assistants cannot provide legal advice. I have to rate her as excellent in all attributes I was looking for. I found out that a will wasnt anything, that we for sure needed a Living Trust (as do most adults).