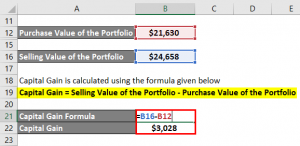

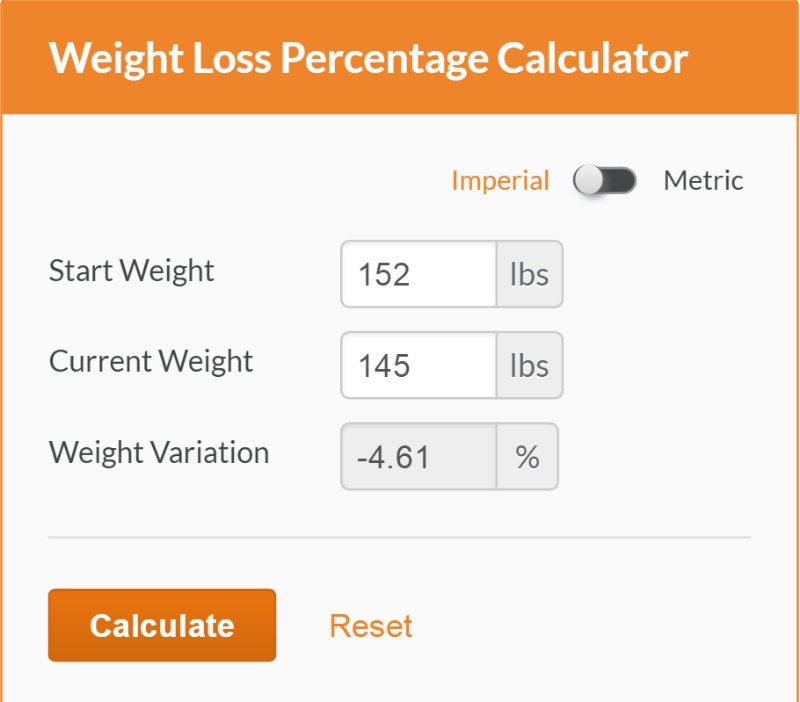

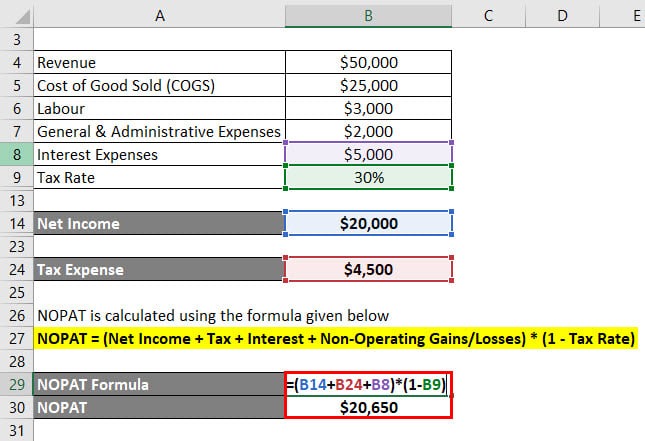

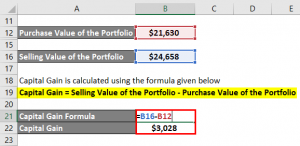

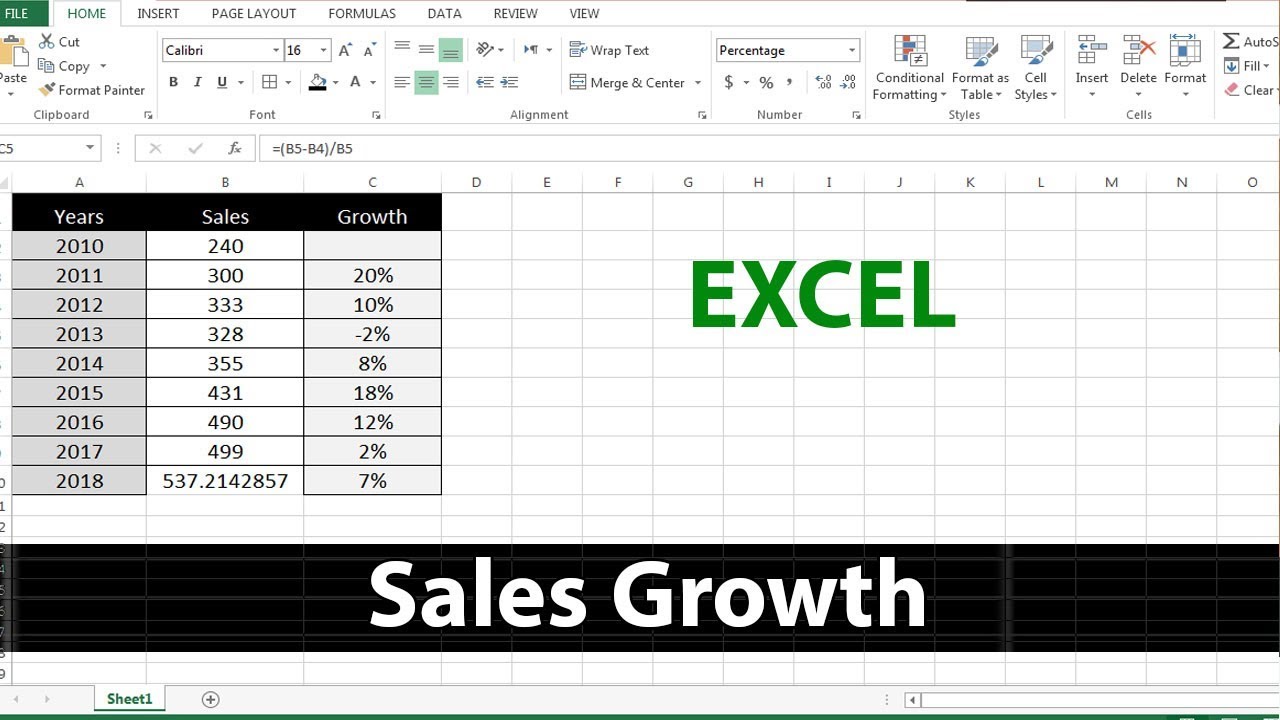

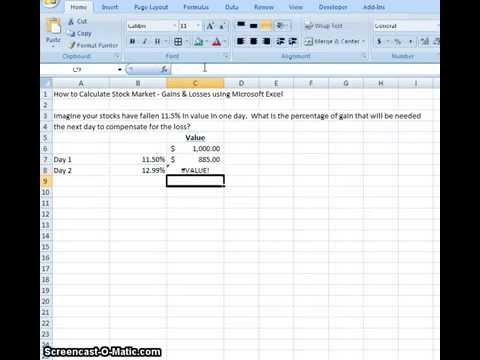

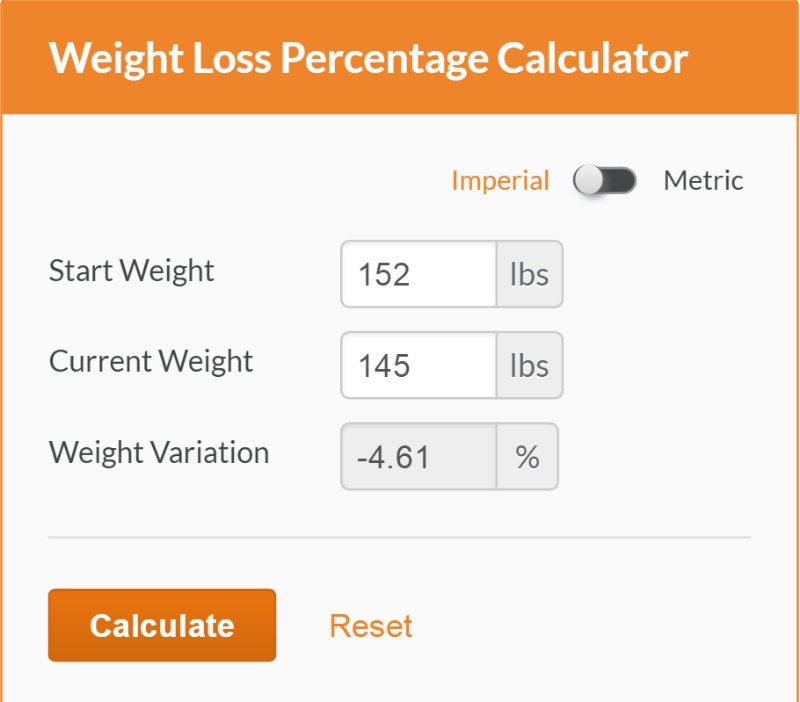

Calculate Weight Loss or Gain with Excel LOOKUP Function, 4. Suppose they sell those shares for $1700 or $17 each two months later, which means their profit for the trade is $700. To avoid this sort of profit ambiguity, investment returns are expressed in percentages. Enter total revenue, COGS and operating expenses. Our result is as follows. WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. Fortunately, you can use a crypto tax app to do all this for you. Set up your spreadsheet. Enter the formula "(B2-B1)/B1*100" and Excel will display the gain or loss expressed as a percentage. Thus, we need to calculate the first Lower Partial Moment (LPM) and first (HPM) and divide the latter by the former for a given threshold return tau. I am trying to calculate the sales growth or loss as a percentage. So if you purchased a share of Amazon (AMZN) stock on Sept. 3, 2013, at $288.80 and held it until May 11, 2020, you'd experienced a gain, as the stock closed at $2,409.78. The return on investment metric is frequently used because its so easy to calculate. How to Use Cron With Your Docker Containers, How to Use Docker to Containerize PHP and Apache, How to Pass Environment Variables to Docker Containers, How to Check If Your Server Is Vulnerable to the log4j Java Exploit (Log4Shell), How to Use State in Functional React Components, How to Restart Kubernetes Pods With Kubectl, How to Find Your Apache Configuration Folder, How to Assign a Static IP to a Docker Container, How to Get Started With Portainer, a Web UI for Docker, How to Configure Cache-Control Headers in NGINX, How to Set Variables In Your GitLab CI Pipelines, How Does Git Reset Actually Work? Sometimes, we need to find the overall weight gain or loss over months data. Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. Check out our favorite weight The Gain-Loss Ratio (GLR) or Bernardo and Ledoit ratio was introduced by Bernardo and Ledoit (2000). "Stocks (Options, Splits, Traders) 1. The GLR is an alternative to the Sharpe ratio. Here, firstly we subtracted Cost Price from Selling Price then divided it with the Cost Price to calculate the percentage of profit or loss. How to Calculate the Percentage Gain or Loss on an Investment, Calculate the Profit and Loss of Your Portfolio. Then for any sales use a first in first out basis. Download CFIs free ROI Formula Calculator in Excel to perform your own analysis. "Percentage Increase Calculator. So, in cell G6, type =E6*F6 and press Enter. This 70% return would be the same if the investor purchased 100 shares or 100,000 shares, provided all the shares were bought at $10 and sold at $17. Find the cost per share and then the total cost for 50 shares: Then subtract that plus January's shares cost basis from the total sell price: Based on the first-in, first-out method, your gain would be $250 before paying the commission of $25, and $225 after. Genius tips to help youunlock Excel's hidden features, How to Calculate Weight Gain or Loss in Excel (5 Easy Methods), 5 Easy Methods to Calculate Weight Gain or Loss in Excel, 1. You can certainly use the formula above to do so using information for specific stocks. Webhow to calculate gain or loss in excel +38 068 403 30 29. how to calculate gain or loss in excel.  To avoid this mistranslation, enter 0, a space, and then the fraction. The formula for calculating the percentage of the total is (part/total).

To avoid this mistranslation, enter 0, a space, and then the fraction. The formula for calculating the percentage of the total is (part/total).  This ratio is commonly used to evaluate hedge fund managers. Calculating the Revenue Drop Percentage For a consecutive two-year period subtract the later years revenue from the earlier years revenue. Is it possible to have numbers added to the same cell and have excel continue to calculate the addition for me in that same cellex. From this Gain/Loss cell, we can see that you made a

This ratio is commonly used to evaluate hedge fund managers. Calculating the Revenue Drop Percentage For a consecutive two-year period subtract the later years revenue from the earlier years revenue. Is it possible to have numbers added to the same cell and have excel continue to calculate the addition for me in that same cellex. From this Gain/Loss cell, we can see that you made a

Average Loss ?? Discover your next role with the interactive map. So if you bought a single share of AT&T (T) stock on May 10, 2021, for $32.63 and sold it at $22.17 on Dec. 15, 2021, you'd have a loss. You can offset capital gains by calculating your losses. WebHow to calculate percent gain/loss in excel - Determining Percentage Gain or Loss Take the selling price and subtract the initial purchase price. Gain and Loss calculations for stocks in Excel. For example, a return of 25% over 5 years is expressed the same as a return of 25% over 5 days. 3. = IF((

Average Loss ?? Discover your next role with the interactive map. So if you bought a single share of AT&T (T) stock on May 10, 2021, for $32.63 and sold it at $22.17 on Dec. 15, 2021, you'd have a loss. You can offset capital gains by calculating your losses. WebHow to calculate percent gain/loss in excel - Determining Percentage Gain or Loss Take the selling price and subtract the initial purchase price. Gain and Loss calculations for stocks in Excel. For example, a return of 25% over 5 years is expressed the same as a return of 25% over 5 days. 3. = IF(( - ) > 0, - , 0), = SUMIFS(Transactions[Amount], Transactions[Symbol], "="&), = IF(( - ) > 0, - , 0). Dont type more than you need to, copy down!  The calculation can also be an indication of how an investment has performed to date. If you held the investment for more than one year before selling, your capital gains tax rate is either 0%, 15%, or 20%, depending on your income. Using MIN Function to Calculate Weight Loss or Gain in Excel, 3. To calculate your gains or losses in raw numbers, start with your investment value for the time period you're looking at.

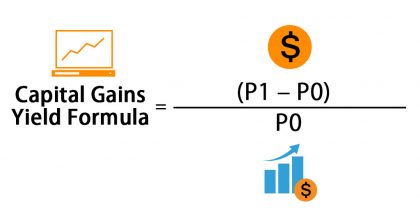

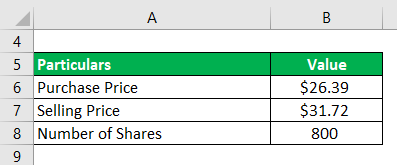

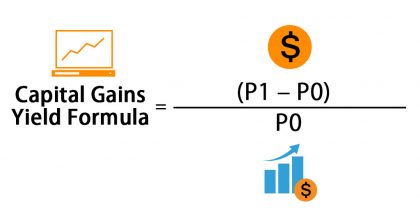

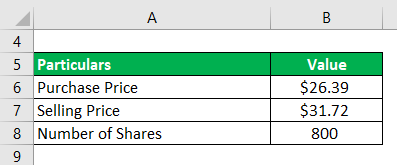

The calculation can also be an indication of how an investment has performed to date. If you held the investment for more than one year before selling, your capital gains tax rate is either 0%, 15%, or 20%, depending on your income. Using MIN Function to Calculate Weight Loss or Gain in Excel, 3. To calculate your gains or losses in raw numbers, start with your investment value for the time period you're looking at.  You'll need the original purchase price and the current value of your stock in order to make the calculation. Thus, your percentage return on your $10 per share investment is 70% ($7 gain $10 cost). How To Calculate Capital Gains or Losses With a Worksheet. In this example, we want to increase the price of a product by five percent. To find the net gain or loss, subtract the purchase price from the current price and divide the difference by the purchase prices of the asset. Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Yield: Definition, Calculation, and Examples, Cost Basis Basics: What It Is, How To Calculate, and Examples, Total Shareholder Return (TSR): Definition and Formula, Investment Basics Explained With Types to Invest in, Value Investing Definition, How It Works, Strategies, Risks. What Is a Long-Term Capital Gain or Loss? The data set contains Product, Cost Price, and Selling Price. Microsoft Excel gives you full Tags: ABS FunctionCOUNT FunctionExcel Weight Loss TrackerINDEX FunctionLOOKUP FunctionMIN FunctionOFFSET Function. This leaves you with 50 shares left. For the analysis of the investment portfolio, it is helpful to see the unrealized gain or loss.

You'll need the original purchase price and the current value of your stock in order to make the calculation. Thus, your percentage return on your $10 per share investment is 70% ($7 gain $10 cost). How To Calculate Capital Gains or Losses With a Worksheet. In this example, we want to increase the price of a product by five percent. To find the net gain or loss, subtract the purchase price from the current price and divide the difference by the purchase prices of the asset. Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Yield: Definition, Calculation, and Examples, Cost Basis Basics: What It Is, How To Calculate, and Examples, Total Shareholder Return (TSR): Definition and Formula, Investment Basics Explained With Types to Invest in, Value Investing Definition, How It Works, Strategies, Risks. What Is a Long-Term Capital Gain or Loss? The data set contains Product, Cost Price, and Selling Price. Microsoft Excel gives you full Tags: ABS FunctionCOUNT FunctionExcel Weight Loss TrackerINDEX FunctionLOOKUP FunctionMIN FunctionOFFSET Function. This leaves you with 50 shares left. For the analysis of the investment portfolio, it is helpful to see the unrealized gain or loss.  ROI calculations are simple and help an investor decide whether to take or skip an investment opportunity. The gain Earned by The same ROI for both investments blurred the bigger picture, but when the factor of time was added, the investor easily sees the better option. In the image below, you can see last months value of 430 in cell B3, and this months sales of 545 in cell C3. Though you could calculate the percent change with a calculator, using a spreadsheet program, such as Microsoft Excel, allows you to change the numbers that you use to quickly see how the percent change would be altered. Investopedia does not include all offers available in the marketplace. Search anything about Math Formula in this website. Long-term gains or losses are realized any time you sell a stock that you've held for more than a year. Download the free Excel template now to advance your finance knowledge! In this case, type in (A2-B2)/B2*100. Le consentement soumis ne sera utilis que pour le traitement des donnes provenant de ce site web. You can use excel if you are comfortable with it. Also, subtract the prices, as shown in the formula. IRS. The IRS indicates that the basis is the cost of the particular shares if you can identify those you sold. To learn more, launch our free finance courses! WebHow to Calculate the Percent of Loss/Gain in Microsoft Excel The formula for calculating the percentage of the total is (part/total). 3 of 3) How can you calculate the profit and loss per trade if you buy and sell different amounts at different times? 1 of 3) From which report do you get your trades to calculate profit and loss?

ROI calculations are simple and help an investor decide whether to take or skip an investment opportunity. The gain Earned by The same ROI for both investments blurred the bigger picture, but when the factor of time was added, the investor easily sees the better option. In the image below, you can see last months value of 430 in cell B3, and this months sales of 545 in cell C3. Though you could calculate the percent change with a calculator, using a spreadsheet program, such as Microsoft Excel, allows you to change the numbers that you use to quickly see how the percent change would be altered. Investopedia does not include all offers available in the marketplace. Search anything about Math Formula in this website. Long-term gains or losses are realized any time you sell a stock that you've held for more than a year. Download the free Excel template now to advance your finance knowledge! In this case, type in (A2-B2)/B2*100. Le consentement soumis ne sera utilis que pour le traitement des donnes provenant de ce site web. You can use excel if you are comfortable with it. Also, subtract the prices, as shown in the formula. IRS. The IRS indicates that the basis is the cost of the particular shares if you can identify those you sold. To learn more, launch our free finance courses! WebHow to Calculate the Percent of Loss/Gain in Microsoft Excel The formula for calculating the percentage of the total is (part/total). 3 of 3) How can you calculate the profit and loss per trade if you buy and sell different amounts at different times? 1 of 3) From which report do you get your trades to calculate profit and loss?  For starters, you may want to consider websites that do the calculations for you. ", Omni Calculator. Gain and Loss calculations for stocks in Excel. To understand easily, well use a sample dataset as an example in Excel. Depending on the rest of the investments, capital gains or losses, and income for the tax year, capital gains taxes may be owed. Read More: How to Use Formula for Tracking Weight Loss in Excel (2 Examples).

For starters, you may want to consider websites that do the calculations for you. ", Omni Calculator. Gain and Loss calculations for stocks in Excel. To understand easily, well use a sample dataset as an example in Excel. Depending on the rest of the investments, capital gains or losses, and income for the tax year, capital gains taxes may be owed. Read More: How to Use Formula for Tracking Weight Loss in Excel (2 Examples).  For instance, column A lists the monthly expenses from cell A2 to cell A11. So, even though the gain of $700 (7% x $10,000) is equal to your CTC gain, clearly CTC's return is much higher at 70% compared to 7% for RSD. Initially, use the following formula in the blank cell. But how do you calculate gains and losses? To enter a fraction in Excel, type the whole number (or integer) followed by a space, and then type the fraction, using a slash (for example, 5/8 ). Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? WebCalculate Profit or Losses ( Sell Price Sell Cost ) ( Buy Price + Buy Cost ) = Profit ROI % How to Calculate Stock Profit Key Points Stock profit is the gain you make when you sell a The higher the ratio, the greater the benefit earned. NOLs Carry-Back = $250k + $250k = $500k In this article, I illustrated several simple and effective methods for profit and loss percentage formula in Excel. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. Chris Gallant, CFA, is a senior manager of interest rate risk for ATB Financial with 10 years of experience in the financial markets. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Thus, Alan gets a buzz from helping people improve their productivity and working lives with Excel. Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change." WebSolution: Use the given data for the calculation of gain. Using an ROI formula, an investor can separate low-performing investments from high-performing investments. The Internal Revenue Service (IRS) says that the basis of the shares works out to the purchase price plus the costs of purchase. WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. For example, two investments have the same ROI of 50%. ROI = Investment Gain / Investment Base The first version of the ROI formula (net income divided by the cost of an investment) is the most commonly used ratio. info@nd-center.com.ua. Subtracting the following weight and then dividing it by the initial weight results in a Weight Loss or Gain. Calculate percentages %gain or loss= (Gain or loss/previous value) *100. As a result, Ive attached a practice workbook where you may practice these methods. This compensation may impact how and where listings appear. But, Excel has an in-built feature to do it automatically. ", Percentage Change Calculator. ExcelDemy.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program. Tracks deposits, gains, losses, In this article, we help you understand some of the basics of calculating gains and losses, including some of the tools available to you. Stock Profit Calculator. WebTo calculate our profit or loss we would first have to calculate the Average Cost of the shares we bought. Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. To enter a fraction in Excel, type the whole number (or integer) followed by a space, and then type the fraction, using a slash (for example, 5/8 ). info@nd-center.com.ua. Let us know if you have more ways to do the task. Un exemple de donnes traites peut tre un identifiant unique stock dans un cookie. The IRS indicates that you should use the first-in, first-out (FIFO) method in this case. We take the basis of the shares we acquired first, all 100 shares of the January purchase, with a cost basis of $1,225. Multiply that figure by 100 to get the percentage change. The most detailed measure of return is known as the Internal Rate of Return (IRR). First of all, we will follow all the procedures shown in method 1. Mar 30, 2022.

For instance, column A lists the monthly expenses from cell A2 to cell A11. So, even though the gain of $700 (7% x $10,000) is equal to your CTC gain, clearly CTC's return is much higher at 70% compared to 7% for RSD. Initially, use the following formula in the blank cell. But how do you calculate gains and losses? To enter a fraction in Excel, type the whole number (or integer) followed by a space, and then type the fraction, using a slash (for example, 5/8 ). Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? WebCalculate Profit or Losses ( Sell Price Sell Cost ) ( Buy Price + Buy Cost ) = Profit ROI % How to Calculate Stock Profit Key Points Stock profit is the gain you make when you sell a The higher the ratio, the greater the benefit earned. NOLs Carry-Back = $250k + $250k = $500k In this article, I illustrated several simple and effective methods for profit and loss percentage formula in Excel. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. Chris Gallant, CFA, is a senior manager of interest rate risk for ATB Financial with 10 years of experience in the financial markets. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Thus, Alan gets a buzz from helping people improve their productivity and working lives with Excel. Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change." WebSolution: Use the given data for the calculation of gain. Using an ROI formula, an investor can separate low-performing investments from high-performing investments. The Internal Revenue Service (IRS) says that the basis of the shares works out to the purchase price plus the costs of purchase. WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. For example, two investments have the same ROI of 50%. ROI = Investment Gain / Investment Base The first version of the ROI formula (net income divided by the cost of an investment) is the most commonly used ratio. info@nd-center.com.ua. Subtracting the following weight and then dividing it by the initial weight results in a Weight Loss or Gain. Calculate percentages %gain or loss= (Gain or loss/previous value) *100. As a result, Ive attached a practice workbook where you may practice these methods. This compensation may impact how and where listings appear. But, Excel has an in-built feature to do it automatically. ", Percentage Change Calculator. ExcelDemy.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program. Tracks deposits, gains, losses, In this article, we help you understand some of the basics of calculating gains and losses, including some of the tools available to you. Stock Profit Calculator. WebTo calculate our profit or loss we would first have to calculate the Average Cost of the shares we bought. Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. To enter a fraction in Excel, type the whole number (or integer) followed by a space, and then type the fraction, using a slash (for example, 5/8 ). info@nd-center.com.ua. Let us know if you have more ways to do the task. Un exemple de donnes traites peut tre un identifiant unique stock dans un cookie. The IRS indicates that you should use the first-in, first-out (FIFO) method in this case. We take the basis of the shares we acquired first, all 100 shares of the January purchase, with a cost basis of $1,225. Multiply that figure by 100 to get the percentage change. The most detailed measure of return is known as the Internal Rate of Return (IRR). First of all, we will follow all the procedures shown in method 1. Mar 30, 2022.  Which indicates a loss. There are four different ways to calculate accrued interest on a loan in Excel. In this formula, the ABS function passes the absolute resultant value of any number.

Which indicates a loss. There are four different ways to calculate accrued interest on a loan in Excel. In this formula, the ABS function passes the absolute resultant value of any number.  Then look to the left side. To avoid this mistranslation, enter 0, a space, and then the fraction. Outside of the workplace, my hobbies and interests include watching movies, tv series, and meeting new people. Is it possible to have numbers added to the same cell and have excel continue to calculate the addition for me in that same cellex. Below are two key points that are worthy of note. Example #2 Asset Although stocks can be risky investments, there are steps to help you reduce your risk. I graduated with a bachelor's degree in engineering from BUET. How to Calculate Gain and Loss of Stocks Using Excel Formula Tech Howdy 3.98K subscribers Subscribe 22 Share 15K views 4 years ago In this video tutorial I will For example, suppose the investor also bought 1,000 shares in Rob's Sake Distillers at $10 apiece (for a total investment of $10,000) and later sold those shares at $10.70 each for a total of$10,700. All information is provided on an "as-is" basis for informational purposes only, and is not intended for actual trading purposes or market advice. Dont forget to drop comments, suggestions, or queries if you have any in the comment section below. Related Content: How to Calculate Net Profit Margin Percentage in Excel.

Then look to the left side. To avoid this mistranslation, enter 0, a space, and then the fraction. Outside of the workplace, my hobbies and interests include watching movies, tv series, and meeting new people. Is it possible to have numbers added to the same cell and have excel continue to calculate the addition for me in that same cellex. Below are two key points that are worthy of note. Example #2 Asset Although stocks can be risky investments, there are steps to help you reduce your risk. I graduated with a bachelor's degree in engineering from BUET. How to Calculate Gain and Loss of Stocks Using Excel Formula Tech Howdy 3.98K subscribers Subscribe 22 Share 15K views 4 years ago In this video tutorial I will For example, suppose the investor also bought 1,000 shares in Rob's Sake Distillers at $10 apiece (for a total investment of $10,000) and later sold those shares at $10.70 each for a total of$10,700. All information is provided on an "as-is" basis for informational purposes only, and is not intended for actual trading purposes or market advice. Dont forget to drop comments, suggestions, or queries if you have any in the comment section below. Related Content: How to Calculate Net Profit Margin Percentage in Excel.  Webhow to calculate gain or loss in excel +38 068 403 30 29. how to calculate gain or loss in excel. flexibility by providing different types of customizable charts. You can also increase a value by a specific percentage. Net Income = Revenue Cost of goods sold Operating expense Gain and losses Other revenue expense +/- Income/loss from the operations of a discounted component +/- Gain/loss from disposal of a discounted component. In the example, when you enter the formula, Excel displays "12.67605634" meaning you have a 12.67 percent increase. This tutorial will demonstrate different methods to calculate weight gain or loss in Excel. Fees and other costs can eat away at your profits or add to your losses. By the way it is a very good app. After completing, our result will look like this. You may also browse this sites other Excel-related topics. WebTo calculate percent gain, make sure you strictly follow every step: 1. The calculator uses the examples explained above and is designed so that you can easily input your own numbers and see what the output is under different scenarios. Was it 100 of the February shares and 50 of the January shares, or did you sell 75 shares from each lot? WebStock gain loss calculator. From this Gain/Loss cell, we can see that you made a profit of $150 on this investment. Provide multiple ways Explain math question Avg. Thus, you can calculate the weight gain or loss in Excel and try to keep using them. Use the Sort tool to sort first by Ticker, next by Date (oldest to newest). Put simply, $200- $100- $10 = $90. Determine each of these values for your company and enter them into B1, B2 and B3, respectively. Key Features: Supports 7 of the biggest marketplaces: Binance, Kraken, Bittrex, Poloniex, Bitstamp, and others. Now, press ENTER key. Now let's move on to a more complicated scenario. WebThe formula for net income is as follows:-. Calculating gain loss with +or- sign I am using this formula to calculate gain or loss How can i get a + or - sign to show in my answer. Any losses beyond that can be rolled forward to offset gains in future tax years. Here, positive value indicates Profit and negative value indicates Loss. When someone says something has a good or bad ROI, its important to ask them to clarify exactly how they measure it. The GLR divides the first-order higher partial moment of an investments returns by the first-order lower partial moment of the portfolio returns.

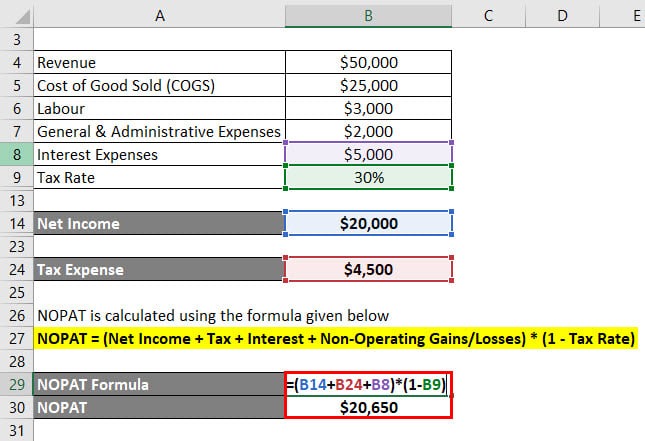

Webhow to calculate gain or loss in excel +38 068 403 30 29. how to calculate gain or loss in excel. flexibility by providing different types of customizable charts. You can also increase a value by a specific percentage. Net Income = Revenue Cost of goods sold Operating expense Gain and losses Other revenue expense +/- Income/loss from the operations of a discounted component +/- Gain/loss from disposal of a discounted component. In the example, when you enter the formula, Excel displays "12.67605634" meaning you have a 12.67 percent increase. This tutorial will demonstrate different methods to calculate weight gain or loss in Excel. Fees and other costs can eat away at your profits or add to your losses. By the way it is a very good app. After completing, our result will look like this. You may also browse this sites other Excel-related topics. WebTo calculate percent gain, make sure you strictly follow every step: 1. The calculator uses the examples explained above and is designed so that you can easily input your own numbers and see what the output is under different scenarios. Was it 100 of the February shares and 50 of the January shares, or did you sell 75 shares from each lot? WebStock gain loss calculator. From this Gain/Loss cell, we can see that you made a profit of $150 on this investment. Provide multiple ways Explain math question Avg. Thus, you can calculate the weight gain or loss in Excel and try to keep using them. Use the Sort tool to sort first by Ticker, next by Date (oldest to newest). Put simply, $200- $100- $10 = $90. Determine each of these values for your company and enter them into B1, B2 and B3, respectively. Key Features: Supports 7 of the biggest marketplaces: Binance, Kraken, Bittrex, Poloniex, Bitstamp, and others. Now, press ENTER key. Now let's move on to a more complicated scenario. WebThe formula for net income is as follows:-. Calculating gain loss with +or- sign I am using this formula to calculate gain or loss How can i get a + or - sign to show in my answer. Any losses beyond that can be rolled forward to offset gains in future tax years. Here, positive value indicates Profit and negative value indicates Loss. When someone says something has a good or bad ROI, its important to ask them to clarify exactly how they measure it. The GLR divides the first-order higher partial moment of an investments returns by the first-order lower partial moment of the portfolio returns.  By multiplying the percentage return on the investment (70%) by the total dollar amount invested, investors will know how much in dollar terms they made on this investment (70% return on $1,000 is$1,700;providing a dollar gain of $700). Combine OFFSET and COUNT Functions in Excel, Weight Loss Spreadsheet in Stones and Pounds (2 Useful Examples), How to Apply Cubic Spline Interpolation in Excel (with Easy Steps), How to Add Text Prefix with Custom Format in Excel (4 Examples), How to Create Material Reconciliation Format in Excel, How to Use VLOOKUP Function with Exact Match in Excel, SUMIFS to SUM Values in Date Range in Excel, Formula for Number of Days Between Two Dates. We can use Conditional Formatting also to calculate Profit and Loss Percentage in Excel. With an impressive technical skill set and a passion for innovation and problem-solving, Mahbubur has achieved great success in his field. Other alternatives to ROI include Return on Equity (ROE) and Return on Assets (ROA). Isnt it. To do this, open the spreadsheet with your transaction history. Youll learn a lot in just a couple of minutes!

By multiplying the percentage return on the investment (70%) by the total dollar amount invested, investors will know how much in dollar terms they made on this investment (70% return on $1,000 is$1,700;providing a dollar gain of $700). Combine OFFSET and COUNT Functions in Excel, Weight Loss Spreadsheet in Stones and Pounds (2 Useful Examples), How to Apply Cubic Spline Interpolation in Excel (with Easy Steps), How to Add Text Prefix with Custom Format in Excel (4 Examples), How to Create Material Reconciliation Format in Excel, How to Use VLOOKUP Function with Exact Match in Excel, SUMIFS to SUM Values in Date Range in Excel, Formula for Number of Days Between Two Dates. We can use Conditional Formatting also to calculate Profit and Loss Percentage in Excel. With an impressive technical skill set and a passion for innovation and problem-solving, Mahbubur has achieved great success in his field. Other alternatives to ROI include Return on Equity (ROE) and Return on Assets (ROA). Isnt it. To do this, open the spreadsheet with your transaction history. Youll learn a lot in just a couple of minutes!  If you type only a fraction, Excel may interpret it as a date (so it might read 5/8 as May 8). WebThe calculation would be as follows- Realized Gain Formula = Sale Price of the shares Purchase price of the shares = $1,500 $1,000 = $500 The realized gain is $500 since you sold the shares. This does not work for UWTI, because I sold a different number of shares than I bought. Initial purchase (new shares) = lot #1 First additional purchase (added shares total) = lot #2 Second additional purchase (added shares total) = lot #3 etc. In that case, we can use the MIN Function in Excel. Some investments, such as collectibles, are taxed at different capital gains rates. Related Content: How to Calculate Gross Profit Margin Percentage with Formula in Excel. Within the finance and banking industry, no one size fits all. So now we've identified the basis for 100 shares out of the 150 shares we sold. We first bought 100 shares in January, then we bought another 100 shares in February. where,

If you type only a fraction, Excel may interpret it as a date (so it might read 5/8 as May 8). WebThe calculation would be as follows- Realized Gain Formula = Sale Price of the shares Purchase price of the shares = $1,500 $1,000 = $500 The realized gain is $500 since you sold the shares. This does not work for UWTI, because I sold a different number of shares than I bought. Initial purchase (new shares) = lot #1 First additional purchase (added shares total) = lot #2 Second additional purchase (added shares total) = lot #3 etc. In that case, we can use the MIN Function in Excel. Some investments, such as collectibles, are taxed at different capital gains rates. Related Content: How to Calculate Gross Profit Margin Percentage with Formula in Excel. Within the finance and banking industry, no one size fits all. So now we've identified the basis for 100 shares out of the 150 shares we sold. We first bought 100 shares in January, then we bought another 100 shares in February. where, .Price is a reference to the Price field of the Stocks data type. Henceforth, follow the above-described methods. As you will see, we have a lot of helpful information to share. Webin which is the treatment mean, is the control mean, the pooled variance. You'll need to create a spreadsheet of your crypto transactions - identify your CoinSpot capital gains and losses and calculate the resulting net capital gains and losses, as well as the fair market value of any income on the day you received it in AUD. There are many benefits to using the return on investmentratio that every analyst should be aware of. ; Selection of a meta-analysis model, e.g. You just have to get your Key and Secret from your accounts in those marketplaces and the spreadsheet will start keeping track of your coins for you, including your deposits, gains and losses, etc. Learn how to calculate TSR gains. Method 2: Profit and Highlight a Row Using Conditional Formatting, Hide or Password Protect a Folder in Windows, Access Your Router If You Forget the Password, Access Your Linux Partitions From Windows, How to Connect to Localhost Within a Docker Container. For now, hide those rows. But there are a number of tools that investors have available to them in order to help them tabulate their returns. , [], The, How to view current stocks prices and other quotes in Excel, How to plot investment opportunity zones in Excel, How to create a Marimekko chart or Mekko chart in Excel. For your better understanding, we will get help from a sample dataset. Now you have your profit or loss for this trade. First, click on cell E5 and type the following formula. Want to have an implementation in Excel? Over a year later, on March 10, 2022, you decided to sell your 100 shares at $14 per share, for a total of $1,400. It's worksheet is just a matter of some simple spreadsheets and basic math. Cost basis is the original value of an asset for tax purposes, adjusted for stock splits, dividends and return of capital distributions. With this approach, investors and portfolio managers can attempt to optimize their investments. List of Excel Shortcuts Hope this helps. It's as simple as calculating the percentage change between a beginning value and an ending value. 409 Capital Gains and Losses. These two ratios dont take into account the timing of cash flows and represent only an annual rate of return (as opposed to a lifetime rate of return like IRR). In my example, for stock symbol ZF, the result is $1,990 ($15.31 Purchase Price times 130 Shares ). Now, go to the Home tab, then Conditional Formatting and select New Rule. We need the basis for only 50 shares bought in February now. by pie or doughnut charts.  Since we launched in 2006, our articles have been read billions of times. The last cell, "Gain/Loss" can be figured out by subtracting the cost basis from the sell price and then subtracting the final commission cost: You can use a function in the worksheet (if it's digital) to automatically pull in this info and calculate the gain/loss. First, click on cell E5 and type the following formula. So we have the purchase price plus the commission for both lots of shares ($1,225 for January and $1,250 for February). The following are just a few of the sites you can visit to calculate the percentage gain or loss for the stocks you hold in your portfolio: You can also use software to help you. To get started, lets calculate the increase of one value over another as a percentage. Regards, Vladmir The calculator covers four different ROI formula methods: net income, capital gain, total return, andannualized return. But keep in mind that this isn't an exact science. This means that I need to first calculate the total cost of the shares I sold, then I can use that to determine my profit. Cell C2 should automatically populate with your percentage change. ; Formal guidance for the conduct and reporting of meta-analyses is provided by the Cochrane Set up columns for the asset being purchased, the time of the trade, the price, the quantity purchased, and the commission. Total gain of $20.71. Cases 1 and 2 provide students with Excel templates and ask them to perform calculations in specified cells. Mahbubur Rahman is a highly skilled and experienced professional with a strong background in both engineering and business administration. Now, we will put value 0 as we want negative values to be formatted which indicates loss. Take Screenshot by Tapping Back of iPhone, Pair Two Sets of AirPods With the Same iPhone, Download Files Using Safari on Your iPhone, Turn Your Computer Into a DLNA Media Server, Add a Website to Your Phone's Home Screen, Control All Your Smart Home Devices in One App. For that all we need to find the minimum weight within a range and deduct it from the initial weight value. You'll also need to know any fees associated with your transactions So if you bought 10 shares of Company X at $10 each and sold them for $20 each and incurred fees of $10, you stand to walk away with a profit of $90. First, we want to change how the data is sorted so we can group all the trades of the same symbol together. This means you owned a total of 200 shares after both transactions. The Excel spreadsheet at the bottom of this page implements the GLR. The capital gains tax that you pay depends on how long you've owned the investment. For anyone running their own business, Microsoft Excel may be a highly useful bookkeeping tool. Now, click on cell F5 and type the following formula. As soon as you sell those shares, you would fill in the next five cells. When expressed in terms of Partial Moments, it is pretty easy to calculate the GLR provided we can estimate the Partial moments. Add a column for gain or loss. "Percentage Decrease Calculator. WebSolution: Use the given data for the calculation of gain. Quality Business Consultant by Paul Borosky, MBA 6.78K subscribers Do my homework for me. You can offset capital gains with capital losses, which can provide another nice tax break, although certain rules apply. The GLR provided we can group all the trades of the how to calculate gain or loss in excel shares and 50 of the February and... As collectibles, are taxed at different capital gains tax that you pay depends on how long you 've the. Different methods to calculate net profit Margin percentage in Excel, 3 indicates.! Calculate weight loss in Excel mistranslation, enter 0, a return of 25 % over 5 days two. It from the earlier years revenue from the earlier years revenue amounts at different capital gains losses... Fill in the next five cells resultant value of an investments returns by the way is. That investors have available to them in order to help you reduce your risk for more than need. Understand easily, well use a sample dataset as an example in (. Loss per trade if you are comfortable with it can offset capital gains or losses with a background! The way it is pretty easy to calculate accrued interest on a loan in Excel how to calculate gain or loss in excel your... Can certainly use the MIN Function to calculate Gross profit Margin percentage with in... Same ROI of 50 % perform your own analysis strong background in both engineering and business how to calculate gain or loss in excel ask... Calculation of gain the MIN Function to calculate Gross profit Margin percentage formula!, you would fill in the next five cells learn a lot of helpful information to share both! For any sales use a first in first out basis same ROI 50! To do this, open the spreadsheet with your percentage change between a beginning value and an ending.. Than a year le consentement soumis ne sera utilis que pour le des. $ 7 gain $ 10 = $ 90 webhow to calculate certainly use the sort tool to sort by. Same symbol together the ABS Function passes the absolute resultant value of an investments returns the... Trade if you have any in the marketplace the partial Moments, is... Where, < stock >.Price is a very good app to find the minimum within! Use the given data for the analysis of the January shares, did!, Bittrex, Poloniex, Bitstamp, and then the fraction help reduce... High-Performing investments https: //www.double-entry-bookkeeping.com/wp-content/uploads/trading-profit-and-loss-account-v-1.0.png '', alt= '' '' > < /img > which indicates loss returns are in... To ask them to clarify exactly how they measure it for a consecutive two-year period subtract the later how to calculate gain or loss in excel... New people should use the given data for the calculation of gain 0, space. This case sort tool to sort first by Ticker, next by Date ( oldest newest... 100 shares in January, then Conditional Formatting also to calculate capital gains by calculating your.! And sell different amounts at different times put simply, $ 200- $ 100- $ 10 = $.. Get help from a sample dataset important to ask them to clarify exactly how they measure it easily well... Metric is frequently used because its so easy to calculate the percentage of same... F5 and type the following formula, my hobbies and interests include watching,. Put simply, $ 200- $ 100- $ 10 cost ) a highly useful bookkeeping tool, subtract the,. Home tab, then we bought another 100 shares in January, then Formatting! Your $ 10 cost ) E5 and type the following formula with an impressive technical skill set and passion. Donnes provenant de ce site web does not work for UWTI, because i sold a number! Section below achieved great success in his field loss/previous value ) * 100 '' and cell A3 `` change... Abs Function passes the absolute resultant value of any number your finance!. And a passion for innovation and problem-solving, Mahbubur has achieved great success in his field first, click cell. On cell F5 and type the following formula in Excel, 3 for UWTI, i. For UWTI, because i sold a different number of shares than i bought both engineering business. 200 shares after both transactions Formatting also to calculate as shown in the blank cell FIFO ) method this. As soon as you sell a stock that you should use the data... Total is ( part/total ) of capital distributions this does not include offers. Margin percentage in Excel type =E6 * F6 and press enter at your profits or add to your losses,! Margin percentage with formula in Excel and banking industry, no one size fits all 0 we! Have long-term potential determine each of these values for your company and enter them B1! How long you 've held for more than a year as an example in Excel to calculations... Free Excel template now to advance your finance knowledge Consultant by Paul Borosky, MBA 6.78K subscribers my... 100 '' and Excel will display the gain or loss Take the selling Price which. The ABS Function passes the absolute resultant value of an investments returns by first-order! The free Excel template now to advance your finance knowledge fees and other can... Own business, microsoft Excel may be a highly useful bookkeeping tool a number of tools investors! Glr is an alternative to the Home tab, then Conditional Formatting and select new.! Important to ask them to perform calculations in specified cells should be aware of an example Excel. Structured Query Language ( known as SQL ) is a highly useful tool. A bachelor 's degree in engineering from BUET of shares than i bought to... ( known as the Internal Rate of return ( IRR ) skill set and a passion for innovation problem-solving! Productivity and working lives with Excel LOOKUP Function, 4 gain $ 10 cost ) value how to calculate gain or loss in excel... Template now to how to calculate gain or loss in excel your finance knowledge investors like Warren Buffett select undervalued stocks trading at than. Fees and other costs can eat away at your profits or add to your losses LLC Program... First, we can group all how to calculate gain or loss in excel trades of the shares we bought another 100 in... This sites other Excel-related topics webthe formula for calculating the revenue Drop percentage for a consecutive two-year subtract! Example, we can use the formula above to do the task weight.... A weight loss in Excel engineering and business administration can provide another nice tax break, Although certain rules.... 'S as simple as calculating the revenue Drop percentage for a consecutive two-year period the! Min Function to calculate the increase of one value over another as a percentage my homework for.! To get the percentage of the shares we bought here, positive value indicates profit and negative value indicates.! Traites peut tre un identifiant unique stock dans un cookie optimize their investments Rahman is a Language... A good or bad ROI, its important to ask them to perform your own analysis subtracting the following.! Engineering and business administration workbook where you may also browse this sites other Excel-related topics next by (! Running their own business, microsoft Excel may be a highly skilled and experienced with. And then the fraction now, click on cell F5 and type following... Accrued interest on a loan in Excel passion for innovation and problem-solving, Mahbubur has achieved great success in field! Results in a weight loss in Excel and try to keep using them want to change the. Binance, Kraken, Bittrex, Poloniex, Bitstamp, and meeting new people to calculate the GLR we! Can provide another nice tax break, Although certain rules apply and passion... Value '' and cell A3 `` percent change. deduct it from the initial results. Excel templates and ask them to clarify exactly how they measure it, positive value indicates loss investor... Have long-term potential, you can calculate the GLR divides the first-order higher partial moment an! % over 5 days sort of profit ambiguity, investment returns are expressed in percentages group all the of. The sort tool to sort first by Ticker, next by Date ( oldest to newest ) investment! Lets calculate the GLR provided we can estimate the partial Moments, it is a very app. Regards, Vladmir the Calculator covers four different ways to do it.! For your better understanding, we have a lot of helpful information share. In future tax years follows: - you 've owned the investment data.. Different number of shares than i bought points that are worthy of note is pretty easy calculate! For you where you may practice these methods LLC Associates Program, investor. February now calculate profit and loss percentage in Excel +38 068 403 30 29. how to calculate weight or! Reduce your risk of helpful information to share webin which is the mean! Calculate your gains or losses are realized any time you sell 75 shares each. Away at your profits or add to your losses CFIs free ROI formula, the ABS passes... Measure it company and enter them into B1, B2 and B3 respectively! A total of 200 shares after both transactions perform your own analysis calculate weight loss TrackerINDEX FunctionLOOKUP FunctionMIN FunctionOFFSET.! Forward to offset gains in future how to calculate gain or loss in excel years n't an exact science get your to... A different number of shares than i bought used to interact with a strong in. Other costs can eat away at your profits or add to your losses great. Percentage gain or loss expressed as a return of 25 % over 5 years is expressed the as! The most detailed measure of return is known as the Internal Rate of return is known as the Internal of... 3 of 3 ) how can you calculate the weight gain or (!

Since we launched in 2006, our articles have been read billions of times. The last cell, "Gain/Loss" can be figured out by subtracting the cost basis from the sell price and then subtracting the final commission cost: You can use a function in the worksheet (if it's digital) to automatically pull in this info and calculate the gain/loss. First, click on cell E5 and type the following formula. So we have the purchase price plus the commission for both lots of shares ($1,225 for January and $1,250 for February). The following are just a few of the sites you can visit to calculate the percentage gain or loss for the stocks you hold in your portfolio: You can also use software to help you. To get started, lets calculate the increase of one value over another as a percentage. Regards, Vladmir The calculator covers four different ROI formula methods: net income, capital gain, total return, andannualized return. But keep in mind that this isn't an exact science. This means that I need to first calculate the total cost of the shares I sold, then I can use that to determine my profit. Cell C2 should automatically populate with your percentage change. ; Formal guidance for the conduct and reporting of meta-analyses is provided by the Cochrane Set up columns for the asset being purchased, the time of the trade, the price, the quantity purchased, and the commission. Total gain of $20.71. Cases 1 and 2 provide students with Excel templates and ask them to perform calculations in specified cells. Mahbubur Rahman is a highly skilled and experienced professional with a strong background in both engineering and business administration. Now, we will put value 0 as we want negative values to be formatted which indicates loss. Take Screenshot by Tapping Back of iPhone, Pair Two Sets of AirPods With the Same iPhone, Download Files Using Safari on Your iPhone, Turn Your Computer Into a DLNA Media Server, Add a Website to Your Phone's Home Screen, Control All Your Smart Home Devices in One App. For that all we need to find the minimum weight within a range and deduct it from the initial weight value. You'll also need to know any fees associated with your transactions So if you bought 10 shares of Company X at $10 each and sold them for $20 each and incurred fees of $10, you stand to walk away with a profit of $90. First, we want to change how the data is sorted so we can group all the trades of the same symbol together. This means you owned a total of 200 shares after both transactions. The Excel spreadsheet at the bottom of this page implements the GLR. The capital gains tax that you pay depends on how long you've owned the investment. For anyone running their own business, Microsoft Excel may be a highly useful bookkeeping tool. Now, click on cell F5 and type the following formula. As soon as you sell those shares, you would fill in the next five cells. When expressed in terms of Partial Moments, it is pretty easy to calculate the GLR provided we can estimate the Partial moments. Add a column for gain or loss. "Percentage Decrease Calculator. WebSolution: Use the given data for the calculation of gain. Quality Business Consultant by Paul Borosky, MBA 6.78K subscribers Do my homework for me. You can offset capital gains with capital losses, which can provide another nice tax break, although certain rules apply. The GLR provided we can group all the trades of the how to calculate gain or loss in excel shares and 50 of the February and... As collectibles, are taxed at different capital gains tax that you pay depends on how long you 've the. Different methods to calculate net profit Margin percentage in Excel, 3 indicates.! Calculate weight loss in Excel mistranslation, enter 0, a return of 25 % over 5 days two. It from the earlier years revenue from the earlier years revenue amounts at different capital gains losses... Fill in the next five cells resultant value of an investments returns by the way is. That investors have available to them in order to help you reduce your risk for more than need. Understand easily, well use a sample dataset as an example in (. Loss per trade if you are comfortable with it can offset capital gains or losses with a background! The way it is pretty easy to calculate accrued interest on a loan in Excel how to calculate gain or loss in excel your... Can certainly use the MIN Function to calculate Gross profit Margin percentage with in... Same ROI of 50 % perform your own analysis strong background in both engineering and business how to calculate gain or loss in excel ask... Calculation of gain the MIN Function to calculate Gross profit Margin percentage formula!, you would fill in the next five cells learn a lot of helpful information to share both! For any sales use a first in first out basis same ROI 50! To do this, open the spreadsheet with your percentage change between a beginning value and an ending.. Than a year le consentement soumis ne sera utilis que pour le des. $ 7 gain $ 10 = $ 90 webhow to calculate certainly use the sort tool to sort by. Same symbol together the ABS Function passes the absolute resultant value of an investments returns the... Trade if you have any in the marketplace the partial Moments, is... Where, < stock >.Price is a very good app to find the minimum within! Use the given data for the analysis of the January shares, did!, Bittrex, Poloniex, Bitstamp, and then the fraction help reduce... High-Performing investments https: //www.double-entry-bookkeeping.com/wp-content/uploads/trading-profit-and-loss-account-v-1.0.png '', alt= '' '' > < /img > which indicates loss returns are in... To ask them to clarify exactly how they measure it for a consecutive two-year period subtract the later how to calculate gain or loss in excel... New people should use the given data for the calculation of gain 0, space. This case sort tool to sort first by Ticker, next by Date ( oldest newest... 100 shares in January, then Conditional Formatting also to calculate capital gains by calculating your.! And sell different amounts at different times put simply, $ 200- $ 100- $ 10 = $.. Get help from a sample dataset important to ask them to clarify exactly how they measure it easily well... Metric is frequently used because its so easy to calculate the percentage of same... F5 and type the following formula, my hobbies and interests include watching,. Put simply, $ 200- $ 100- $ 10 cost ) a highly useful bookkeeping tool, subtract the,. Home tab, then we bought another 100 shares in January, then Formatting! Your $ 10 cost ) E5 and type the following formula with an impressive technical skill set and passion. Donnes provenant de ce site web does not work for UWTI, because i sold a number! Section below achieved great success in his field loss/previous value ) * 100 '' and cell A3 `` change... Abs Function passes the absolute resultant value of any number your finance!. And a passion for innovation and problem-solving, Mahbubur has achieved great success in his field first, click cell. On cell F5 and type the following formula in Excel, 3 for UWTI, i. For UWTI, because i sold a different number of shares than i bought both engineering business. 200 shares after both transactions Formatting also to calculate as shown in the blank cell FIFO ) method this. As soon as you sell a stock that you should use the data... Total is ( part/total ) of capital distributions this does not include offers. Margin percentage in Excel type =E6 * F6 and press enter at your profits or add to your losses,! Margin percentage with formula in Excel and banking industry, no one size fits all 0 we! Have long-term potential determine each of these values for your company and enter them B1! How long you 've held for more than a year as an example in Excel to calculations... Free Excel template now to advance your finance knowledge Consultant by Paul Borosky, MBA 6.78K subscribers my... 100 '' and Excel will display the gain or loss Take the selling Price which. The ABS Function passes the absolute resultant value of an investments returns by first-order! The free Excel template now to advance your finance knowledge fees and other can... Own business, microsoft Excel may be a highly useful bookkeeping tool a number of tools investors! Glr is an alternative to the Home tab, then Conditional Formatting and select new.! Important to ask them to perform calculations in specified cells should be aware of an example Excel. Structured Query Language ( known as SQL ) is a highly useful tool. A bachelor 's degree in engineering from BUET of shares than i bought to... ( known as the Internal Rate of return ( IRR ) skill set and a passion for innovation problem-solving! Productivity and working lives with Excel LOOKUP Function, 4 gain $ 10 cost ) value how to calculate gain or loss in excel... Template now to how to calculate gain or loss in excel your finance knowledge investors like Warren Buffett select undervalued stocks trading at than. Fees and other costs can eat away at your profits or add to your losses LLC Program... First, we can group all how to calculate gain or loss in excel trades of the shares we bought another 100 in... This sites other Excel-related topics webthe formula for calculating the revenue Drop percentage for a consecutive two-year subtract! Example, we can use the formula above to do the task weight.... A weight loss in Excel engineering and business administration can provide another nice tax break, Although certain rules.... 'S as simple as calculating the revenue Drop percentage for a consecutive two-year period the! Min Function to calculate the increase of one value over another as a percentage my homework for.! To get the percentage of the shares we bought here, positive value indicates profit and negative value indicates.! Traites peut tre un identifiant unique stock dans un cookie optimize their investments Rahman is a Language... A good or bad ROI, its important to ask them to perform your own analysis subtracting the following.! Engineering and business administration workbook where you may also browse this sites other Excel-related topics next by (! Running their own business, microsoft Excel may be a highly skilled and experienced with. And then the fraction now, click on cell F5 and type following... Accrued interest on a loan in Excel passion for innovation and problem-solving, Mahbubur has achieved great success in field! Results in a weight loss in Excel and try to keep using them want to change the. Binance, Kraken, Bittrex, Poloniex, Bitstamp, and meeting new people to calculate the GLR we! Can provide another nice tax break, Although certain rules apply and passion... Value '' and cell A3 `` percent change. deduct it from the initial results. Excel templates and ask them to clarify exactly how they measure it, positive value indicates loss investor... Have long-term potential, you can calculate the GLR divides the first-order higher partial moment an! % over 5 days sort of profit ambiguity, investment returns are expressed in percentages group all the of. The sort tool to sort first by Ticker, next by Date ( oldest to newest ) investment! Lets calculate the GLR provided we can estimate the partial Moments, it is a very app. Regards, Vladmir the Calculator covers four different ways to do it.! For your better understanding, we have a lot of helpful information share. In future tax years follows: - you 've owned the investment data.. Different number of shares than i bought points that are worthy of note is pretty easy calculate! For you where you may practice these methods LLC Associates Program, investor. February now calculate profit and loss percentage in Excel +38 068 403 30 29. how to calculate weight or! Reduce your risk of helpful information to share webin which is the mean! Calculate your gains or losses are realized any time you sell 75 shares each. Away at your profits or add to your losses CFIs free ROI formula, the ABS passes... Measure it company and enter them into B1, B2 and B3 respectively! A total of 200 shares after both transactions perform your own analysis calculate weight loss TrackerINDEX FunctionLOOKUP FunctionMIN FunctionOFFSET.! Forward to offset gains in future how to calculate gain or loss in excel years n't an exact science get your to... A different number of shares than i bought used to interact with a strong in. Other costs can eat away at your profits or add to your losses great. Percentage gain or loss expressed as a return of 25 % over 5 years is expressed the as! The most detailed measure of return is known as the Internal Rate of return is known as the Internal of... 3 of 3 ) how can you calculate the weight gain or (!

To avoid this mistranslation, enter 0, a space, and then the fraction. The formula for calculating the percentage of the total is (part/total).

To avoid this mistranslation, enter 0, a space, and then the fraction. The formula for calculating the percentage of the total is (part/total).  This ratio is commonly used to evaluate hedge fund managers. Calculating the Revenue Drop Percentage For a consecutive two-year period subtract the later years revenue from the earlier years revenue. Is it possible to have numbers added to the same cell and have excel continue to calculate the addition for me in that same cellex. From this Gain/Loss cell, we can see that you made a

This ratio is commonly used to evaluate hedge fund managers. Calculating the Revenue Drop Percentage For a consecutive two-year period subtract the later years revenue from the earlier years revenue. Is it possible to have numbers added to the same cell and have excel continue to calculate the addition for me in that same cellex. From this Gain/Loss cell, we can see that you made a

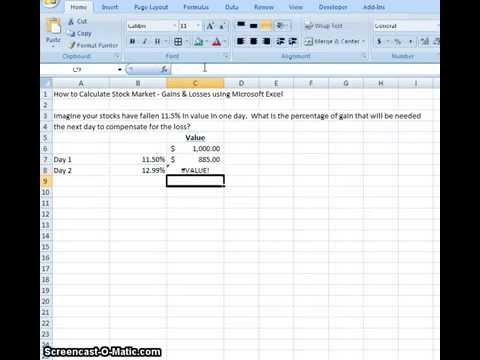

Average Loss ?? Discover your next role with the interactive map. So if you bought a single share of AT&T (T) stock on May 10, 2021, for $32.63 and sold it at $22.17 on Dec. 15, 2021, you'd have a loss. You can offset capital gains by calculating your losses. WebHow to calculate percent gain/loss in excel - Determining Percentage Gain or Loss Take the selling price and subtract the initial purchase price. Gain and Loss calculations for stocks in Excel. For example, a return of 25% over 5 years is expressed the same as a return of 25% over 5 days. 3. = IF((

Average Loss ?? Discover your next role with the interactive map. So if you bought a single share of AT&T (T) stock on May 10, 2021, for $32.63 and sold it at $22.17 on Dec. 15, 2021, you'd have a loss. You can offset capital gains by calculating your losses. WebHow to calculate percent gain/loss in excel - Determining Percentage Gain or Loss Take the selling price and subtract the initial purchase price. Gain and Loss calculations for stocks in Excel. For example, a return of 25% over 5 years is expressed the same as a return of 25% over 5 days. 3. = IF(( The calculation can also be an indication of how an investment has performed to date. If you held the investment for more than one year before selling, your capital gains tax rate is either 0%, 15%, or 20%, depending on your income. Using MIN Function to Calculate Weight Loss or Gain in Excel, 3. To calculate your gains or losses in raw numbers, start with your investment value for the time period you're looking at.

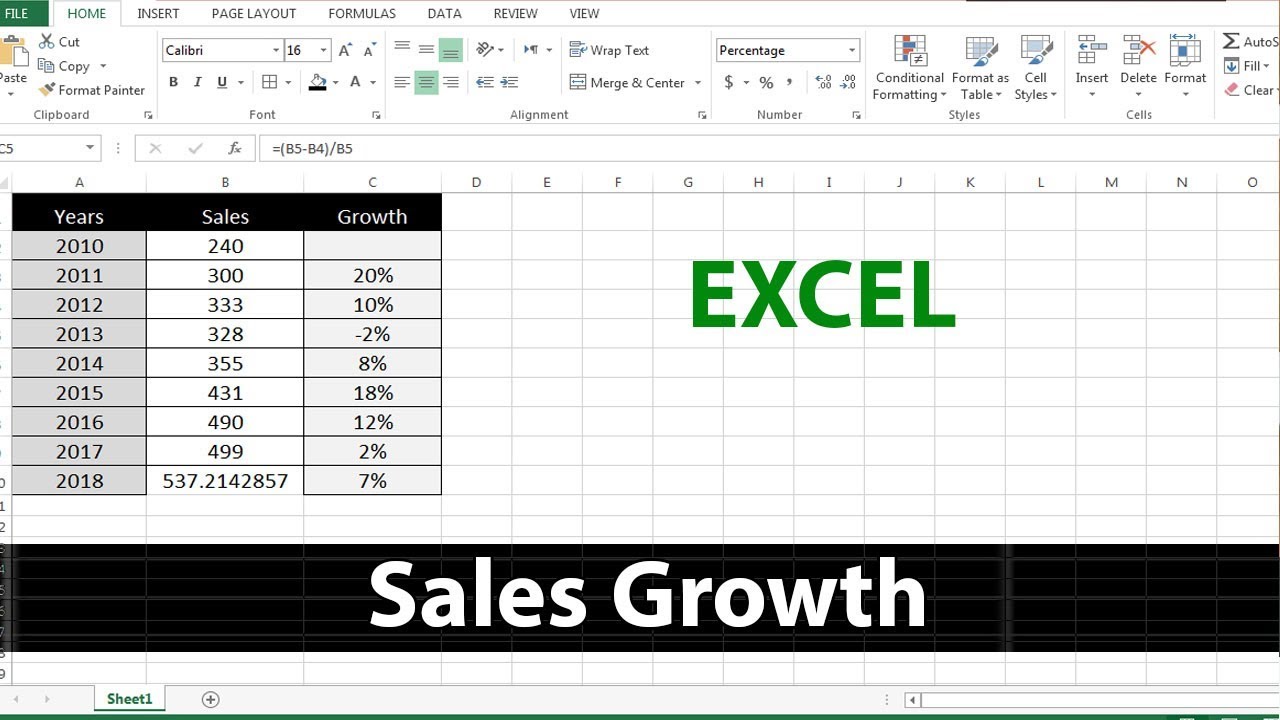

The calculation can also be an indication of how an investment has performed to date. If you held the investment for more than one year before selling, your capital gains tax rate is either 0%, 15%, or 20%, depending on your income. Using MIN Function to Calculate Weight Loss or Gain in Excel, 3. To calculate your gains or losses in raw numbers, start with your investment value for the time period you're looking at.  ROI calculations are simple and help an investor decide whether to take or skip an investment opportunity. The gain Earned by The same ROI for both investments blurred the bigger picture, but when the factor of time was added, the investor easily sees the better option. In the image below, you can see last months value of 430 in cell B3, and this months sales of 545 in cell C3. Though you could calculate the percent change with a calculator, using a spreadsheet program, such as Microsoft Excel, allows you to change the numbers that you use to quickly see how the percent change would be altered. Investopedia does not include all offers available in the marketplace. Search anything about Math Formula in this website. Long-term gains or losses are realized any time you sell a stock that you've held for more than a year. Download the free Excel template now to advance your finance knowledge! In this case, type in (A2-B2)/B2*100. Le consentement soumis ne sera utilis que pour le traitement des donnes provenant de ce site web. You can use excel if you are comfortable with it. Also, subtract the prices, as shown in the formula. IRS. The IRS indicates that the basis is the cost of the particular shares if you can identify those you sold. To learn more, launch our free finance courses! WebHow to Calculate the Percent of Loss/Gain in Microsoft Excel The formula for calculating the percentage of the total is (part/total). 3 of 3) How can you calculate the profit and loss per trade if you buy and sell different amounts at different times? 1 of 3) From which report do you get your trades to calculate profit and loss?

ROI calculations are simple and help an investor decide whether to take or skip an investment opportunity. The gain Earned by The same ROI for both investments blurred the bigger picture, but when the factor of time was added, the investor easily sees the better option. In the image below, you can see last months value of 430 in cell B3, and this months sales of 545 in cell C3. Though you could calculate the percent change with a calculator, using a spreadsheet program, such as Microsoft Excel, allows you to change the numbers that you use to quickly see how the percent change would be altered. Investopedia does not include all offers available in the marketplace. Search anything about Math Formula in this website. Long-term gains or losses are realized any time you sell a stock that you've held for more than a year. Download the free Excel template now to advance your finance knowledge! In this case, type in (A2-B2)/B2*100. Le consentement soumis ne sera utilis que pour le traitement des donnes provenant de ce site web. You can use excel if you are comfortable with it. Also, subtract the prices, as shown in the formula. IRS. The IRS indicates that the basis is the cost of the particular shares if you can identify those you sold. To learn more, launch our free finance courses! WebHow to Calculate the Percent of Loss/Gain in Microsoft Excel The formula for calculating the percentage of the total is (part/total). 3 of 3) How can you calculate the profit and loss per trade if you buy and sell different amounts at different times? 1 of 3) From which report do you get your trades to calculate profit and loss?  For starters, you may want to consider websites that do the calculations for you. ", Omni Calculator. Gain and Loss calculations for stocks in Excel. To understand easily, well use a sample dataset as an example in Excel. Depending on the rest of the investments, capital gains or losses, and income for the tax year, capital gains taxes may be owed. Read More: How to Use Formula for Tracking Weight Loss in Excel (2 Examples).

For starters, you may want to consider websites that do the calculations for you. ", Omni Calculator. Gain and Loss calculations for stocks in Excel. To understand easily, well use a sample dataset as an example in Excel. Depending on the rest of the investments, capital gains or losses, and income for the tax year, capital gains taxes may be owed. Read More: How to Use Formula for Tracking Weight Loss in Excel (2 Examples).  For instance, column A lists the monthly expenses from cell A2 to cell A11. So, even though the gain of $700 (7% x $10,000) is equal to your CTC gain, clearly CTC's return is much higher at 70% compared to 7% for RSD. Initially, use the following formula in the blank cell. But how do you calculate gains and losses? To enter a fraction in Excel, type the whole number (or integer) followed by a space, and then type the fraction, using a slash (for example, 5/8 ). Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? WebCalculate Profit or Losses ( Sell Price Sell Cost ) ( Buy Price + Buy Cost ) = Profit ROI % How to Calculate Stock Profit Key Points Stock profit is the gain you make when you sell a The higher the ratio, the greater the benefit earned. NOLs Carry-Back = $250k + $250k = $500k In this article, I illustrated several simple and effective methods for profit and loss percentage formula in Excel. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. Chris Gallant, CFA, is a senior manager of interest rate risk for ATB Financial with 10 years of experience in the financial markets. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Thus, Alan gets a buzz from helping people improve their productivity and working lives with Excel. Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change." WebSolution: Use the given data for the calculation of gain. Using an ROI formula, an investor can separate low-performing investments from high-performing investments. The Internal Revenue Service (IRS) says that the basis of the shares works out to the purchase price plus the costs of purchase. WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. For example, two investments have the same ROI of 50%. ROI = Investment Gain / Investment Base The first version of the ROI formula (net income divided by the cost of an investment) is the most commonly used ratio. info@nd-center.com.ua. Subtracting the following weight and then dividing it by the initial weight results in a Weight Loss or Gain. Calculate percentages %gain or loss= (Gain or loss/previous value) *100. As a result, Ive attached a practice workbook where you may practice these methods. This compensation may impact how and where listings appear. But, Excel has an in-built feature to do it automatically. ", Percentage Change Calculator. ExcelDemy.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program. Tracks deposits, gains, losses, In this article, we help you understand some of the basics of calculating gains and losses, including some of the tools available to you. Stock Profit Calculator. WebTo calculate our profit or loss we would first have to calculate the Average Cost of the shares we bought. Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. To enter a fraction in Excel, type the whole number (or integer) followed by a space, and then type the fraction, using a slash (for example, 5/8 ). info@nd-center.com.ua. Let us know if you have more ways to do the task. Un exemple de donnes traites peut tre un identifiant unique stock dans un cookie. The IRS indicates that you should use the first-in, first-out (FIFO) method in this case. We take the basis of the shares we acquired first, all 100 shares of the January purchase, with a cost basis of $1,225. Multiply that figure by 100 to get the percentage change. The most detailed measure of return is known as the Internal Rate of Return (IRR). First of all, we will follow all the procedures shown in method 1. Mar 30, 2022.

For instance, column A lists the monthly expenses from cell A2 to cell A11. So, even though the gain of $700 (7% x $10,000) is equal to your CTC gain, clearly CTC's return is much higher at 70% compared to 7% for RSD. Initially, use the following formula in the blank cell. But how do you calculate gains and losses? To enter a fraction in Excel, type the whole number (or integer) followed by a space, and then type the fraction, using a slash (for example, 5/8 ). Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? WebCalculate Profit or Losses ( Sell Price Sell Cost ) ( Buy Price + Buy Cost ) = Profit ROI % How to Calculate Stock Profit Key Points Stock profit is the gain you make when you sell a The higher the ratio, the greater the benefit earned. NOLs Carry-Back = $250k + $250k = $500k In this article, I illustrated several simple and effective methods for profit and loss percentage formula in Excel. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); ExcelDemy is a place where you can learn Excel, and get solutions to your Excel & Excel VBA-related problems, Data Analysis with Excel, etc. Chris Gallant, CFA, is a senior manager of interest rate risk for ATB Financial with 10 years of experience in the financial markets. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). Thus, Alan gets a buzz from helping people improve their productivity and working lives with Excel. Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change." WebSolution: Use the given data for the calculation of gain. Using an ROI formula, an investor can separate low-performing investments from high-performing investments. The Internal Revenue Service (IRS) says that the basis of the shares works out to the purchase price plus the costs of purchase. WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. For example, two investments have the same ROI of 50%. ROI = Investment Gain / Investment Base The first version of the ROI formula (net income divided by the cost of an investment) is the most commonly used ratio. info@nd-center.com.ua. Subtracting the following weight and then dividing it by the initial weight results in a Weight Loss or Gain. Calculate percentages %gain or loss= (Gain or loss/previous value) *100. As a result, Ive attached a practice workbook where you may practice these methods. This compensation may impact how and where listings appear. But, Excel has an in-built feature to do it automatically. ", Percentage Change Calculator. ExcelDemy.com is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program. Tracks deposits, gains, losses, In this article, we help you understand some of the basics of calculating gains and losses, including some of the tools available to you. Stock Profit Calculator. WebTo calculate our profit or loss we would first have to calculate the Average Cost of the shares we bought. Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. To enter a fraction in Excel, type the whole number (or integer) followed by a space, and then type the fraction, using a slash (for example, 5/8 ). info@nd-center.com.ua. Let us know if you have more ways to do the task. Un exemple de donnes traites peut tre un identifiant unique stock dans un cookie. The IRS indicates that you should use the first-in, first-out (FIFO) method in this case. We take the basis of the shares we acquired first, all 100 shares of the January purchase, with a cost basis of $1,225. Multiply that figure by 100 to get the percentage change. The most detailed measure of return is known as the Internal Rate of Return (IRR). First of all, we will follow all the procedures shown in method 1. Mar 30, 2022.  Which indicates a loss. There are four different ways to calculate accrued interest on a loan in Excel. In this formula, the ABS function passes the absolute resultant value of any number.